So very, very tyred

Tyres: they’re resource-intensive, they’re full of toxic nastiness, and they’re everywhere. Jodie Lea Martire asks: what are we going to do with them all?

Globally, 1.7 billion new tyres hit the road each year—and during that same year, over 1 billion existing tyres reach a dead end and become “end-of-life tyres” or ELTs. If that seems like a lot, consider that the worldwide number of road vehicles—and tyres—is expected to double by 2030. Thankfully, 70%–90 % of global ELTs are currently recovered for recycling, either for their material, their energy, or their use in civil engineering projects.

What about here in Australia? According to Tyre Flows and Recycling Analysis, a report prepared by consulting firm Envisage Works for the Department of the Environment and Energy in 2018–19, there were 642 kt on our roads in that period, and we bought another 542 kt (21.3 kg per person). By weight, 43% of the latter were passenger tyres, 33% truck tyres and 24% off-road tyres (“OTR”, which is not a typo—it’s an acronym for “off-the-road” and is the generally accepted tyre industry term) used in mining, aviation, agriculture and construction. On average, OTR tyres in Australia last a single year, while passenger tyres endure for 3.4 years.

During the same 2018-19 period, each Australian generated an average of 18 kg of ELTs, for a national total of 460 kt. Just over half of these—some 255 kt—were sent offshore, with the remaining 208 kt processed here. Since Envisage Works’ report was published, however, Australian tyre recycling practices have taken a dramatic turn.

Regular readers of this series won’t be surprised to hear that this is a result of China’s National Sword policy (implemented in February 2018) and the Council of Australian Governments’ (COAG) strategy in response (dated March 2020). By banning imports of foreign waste, China forced Australia and other lazy nations to deal with their own rubbish. As of December 2021, Australian companies are banned from exporting, “All whole used tyres including baled tyres, but not including bus, truck and aviation tyres exported for re-treading to a verified re-treading facility”.

This means that our ELT export amounts must drop from their previous levels to zero, and must do so pretty much immediately. We’ll look at how this process is going in due course, but first, let’s look at what tyres are made of, and how they’re recycled.

What are tyres made of?

Unlike other recyclables such as glass, paper and plastic, tyres have many components, and comprise both natural or synthetic constituents. A single tyre can contain up to 100 different materials and chemicals, depending on its purpose.

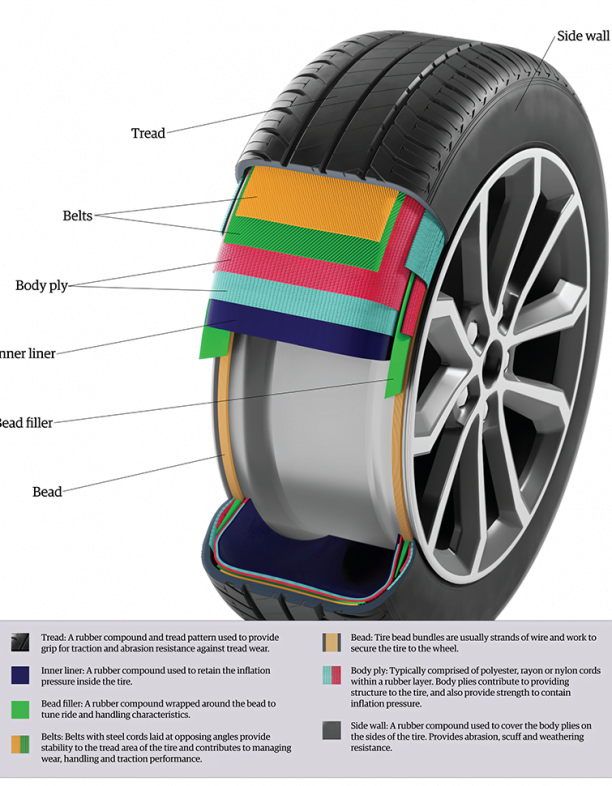

Stucturally, tyres are encased in patterned tread and sidewalls made from rubber compounds. Layers of steel-cord belts are underneath, followed by body ply made up of polyester, rayon or nylon cords within another rubber layer. The inner liner is the last layer before the rim, and again is made of rubber. Around the rim are tyre bead bundles (strands of wire) that hold the tyre to the wheel; the bead itself is then wrapped in rubber known as bead filler. (To be clear, the rim isn’t part of recycling processes.)

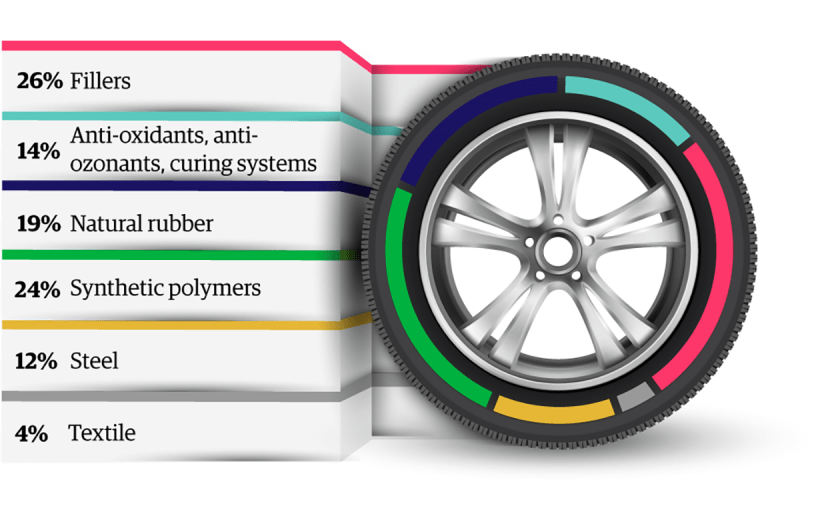

It’s important here to establish exactly what we mean by “rubber”. The primary constituent of tyres is a mixture of natural rubber—from the rubber tree—and synthetic rubber (styrene butadiene rubber or SBR). The proportions used vary depending on the tyre’s purpose: truck and OTR tyres use a ratio of 70% natural rubber to 30% synthetic, while passenger tyres use 35% natural rubber and 65% synthetic. SBR is a hydrocarbon copolymer—that is, a plastic derived from fossil fuels—which is another excellent reason why we should be focusing on efficient tyre-recycling systems.

The amount of other materials used also varies, depending on the tyre’s application: by weight, steel wire comprises 25% of truck/OTR tyres and 16% of passenger tyres. The latter are made up of 7% synthetic fibre (again, derived from fossil fuels). Tyres also include chemicals that serve as antioxidants, antiozonants and curing systems.

Two families of “bonding”, “reinforcing” or “filler” agents—aka manufactured nanomaterials (MNMs)—are also used in all tyres. The first is a variety of materials known by the collective term “furnace carbon black”. Just to confuse you, this term does not refer to soot, charcoal or any other form of the black allotrope of carbon. Instead, it’s a variety of hydrocarbon residues generated when crude oil is distilled but the feedstock isn’t completely combusted (i.e. even more fossil fuels). Carbon black is used as a pigment and extends tyre life by increasing resistance 40-fold to heat and abrasion.

The second family of MNMs is precipitated amorphous silica, or sodium silicate, which refers to a variety of compounds that can be created by melting sand (SiO2) and sodium carbonate (Na2C03) together. This decreases tyres’ rolling resistance, which improves fuel consumption and reduces CO2 emissions. It’s also nasty stuff to be around—while we don’t manufacture tyres here in Australia any more, workers in whichever unfortunate country does get lumbered with this job are at risk of chemical burns, permanent lung damage and—potentially—cancer from exposure to sodium silicate.

The exact nanomaterials in use are held as trade secrets by each tyre company, which raises the spectre of exactly what industrial and environmental regulators in different countries know about those nanoparticles and their impacts. In addition to sodium silicate’s carcinogenic properties, carbon black has also been shown to have toxic effects on the lungs of rats and mice, although the full impacts of MNMs on humans and other forms of life have not yet been investigated. Removing nanoparticles from tyres doesn’t seem to be on anyone’s agenda, but perhaps keeping them rolling in recycled rubber products binds them to functional products and out of our ecosystems for longer.

Most tyres in the global market are made by just a few companies, which makes it easier for alert consumers to track the corporations environmental credentials. The World Business Council for Sustainable Development (WBCSD) works with 11 companies on tracking the environmental safety of tyres. These companies—Bridgestone, Continental, Coopertires, Goodyear, Hankook, Kumho, Michelin, Pirelli, Sumitomo, Toyo and Yokohama—represent 65% of global manufacturing.

As mentioned above, none of these companies—in fact, no tyre companies—manufacture or remanufacture tyres on our shores. The last Australian-made tyre rolled out of the Bridgestone factory in Adelaide in April 2010, taking with it 45 years of business and 600 manufacturing jobs.

How are tyres recycled?

This happens through three main processes: material recovery, energy recovery, and civil engineering and backfilling. The first method means reducing the tyres into components for reuse as tyre-derived materials (TDMs); the second means burning them as tyre-derived fuel (TDF); and the third puts dead tyres to use in retaining walls, road construction or protection from erosion.

Whole tyres can also be repaired, regrooved or retreaded.

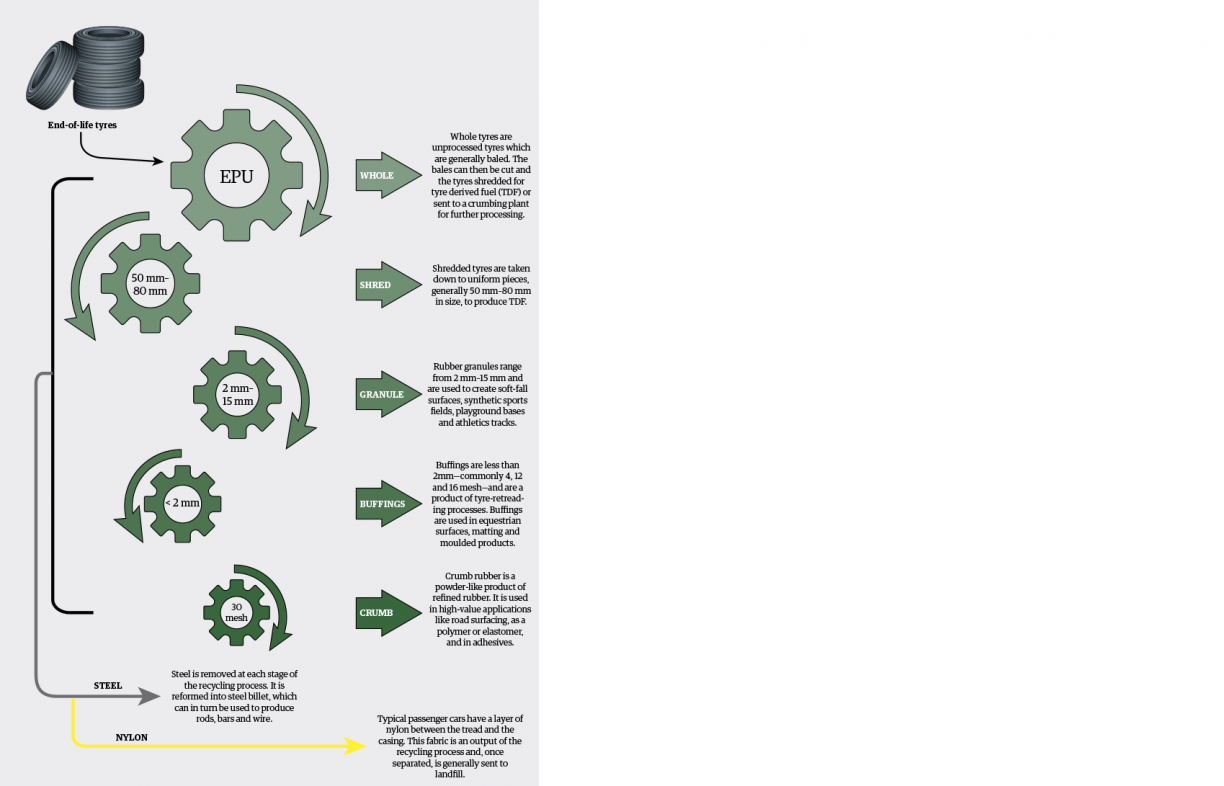

To recover ELT materials, tyres first need to be collected by or delivered to a recycler. From there, unless they’re to be repurposed as-is, they’re run through a shredder or a sequence of machines to split and sort the components.

The first round of shredding or shearing makes tyres more manageable to work with and ensures they can’t hold dirt or water. At this stage, steel is removed—either through a rasper or with magnets—then melted down, reconstituted into steel billet and repurposed as rods, bars and wires. The synthetic fabric from passenger tyres is generally also extracted and landfilled.

Once these components are removed, you’re essentially left with rubber. After the first stage of the process, the rubber is in a form called “shred”, which is pieces between 50 mm–80 mm in size and is used as TDF, where it can replace virgin fossil fuels—like coal, oil and gas—in fuel energy-intensive processes like brickworks, cement kilns, pulp and paper facilities, steel manufacturing and industrial boilers.

Anything not shipped off to be burned for fuel goes to the next round of processing, which involves refining the rubber with grinders or granulators. The resultant material is called granule (2 mm–15 mm); this is used for soft-fall surfaces, sports fields, playground bases and athletics tracks.

Buffings come next—this term refers to pieces under 2 mm, but at this point the measurements start to be made in “mesh”, a unit that refers to being able to pass the pieces through a wire mesh with holes of a specific size. The number refers to the number of holes in one square inch of mesh, so larger numbers mean smaller particles. Buffings are 4, 12 or 16 mesh, and are put to use in equestrian surfaces, matting and moulded products.

And finally there is crumb, which is 30 mesh and is a highly refined, high-value product used for road surfacing (bitumen and asphalt), slope stabilisation, sound and heat barriers, adhesives, explosives, and polymers or elastomers. Other TDM uses include brake pads, industrial and commercial flooring, surface structures at landfill sites, blasting mats, landscaping mulch, and drainage for septic, leachate and landfill gas systems.

Another, entirely separate means of energy recovery is pyrolysis, where tyre rubbers are heated in the absence of oxygen to revert to gaseous, liquid or solid fuel. Pyrolysis generates 45% fuel oil (also called “ship oil” or “bunker oil”); 10% syngas (synthetic natural gas) and steam, both used for electricity production; 15% steel; and, in the right circumstances, 30% char for fertiliser or filtration. A similar process, called gasification, heats tyres with low levels of oxygen and produces the same products but in different ratios.

Graphic: Sustainability Victoria; Vector image: skalapendra/iStockPhoto

What are the benefits of recycling tyres?

First, recycling ELTs means capitalising on natural and manufactured resources, especially the fossil fuels whose exploitation is destroying our planet. Tyres’ high volume of fossil-fuel derivatives (synthetic rubber, synthetic fabric) and products created by burning significant amounts of fossil fuels (steel) mean that recycling should be embedded into the product’s lifecycle—especially as waste tyres are normally tossed after losing only a small portion of their rubber. This is done for safety reasons, obviously, but French tyre company Michelin has demonstrated that 85% of tyres can be reused, and the process of retreading tyres alone (which can be done at least twice, and sometimes up to four times) saves around 60 kg of CO2 emissions each time.

Meanwhile, the relative carbon benefits of TDFs are both dramatic and easy to demonstrate, because they can directly replace virgin fossil fuels. The Australian Tyre Recyclers Association (ATRA) reports that 1 t of TDF replaces 1.14 t of black coal, saving the equivalent of 1.05 t of CO2; 3.02 t of brown coal, saving 1.16t CO2-equivalent; 784 m3 of natural gas (methane); or 780 L of fuel oil.

Another way of looking at this is that burning that single tonne of TDF has the same environmental impact as taking four cars off the road for a year. The World Business Council on Sustainable Development (WBCSD) also states that “in some situations, using TDF instead of virgin fossil fuels reduces nitrogen oxide, sulfur oxide and carbon dioxide emissions”, and leaves fewer heavy metals in the resulting ashes.

Reusing tyres also results in reduced pressure on natural rubber plantations, which each tonne replacing the production of 35 rubber trees. Given this species only thrives within 30 ° of the equator, reusing tyres locally also means avoiding transportation miles for this vital ingredient.

In addition, tyres become a menace in landfill. They do not biodegrade effectively and decompose very, very slowly. In addition to being bulky and collecting water and insects, they have a tendency to “bubble” to the surface because they trap methane. This can result in polluted waterways when the bubbling tyres break through landfill liners, allowing contaminants to leach out. Bacteria in the surrounding soil can be destroyed by the tyres’ stabilisers and flame retardants—and then there are all the microplastics released into soil and water. (It is worth noting that tyres also release microplastics during their production and active life—there’s plenty to read on tyre and road-wear particles (TRWP), of which 80 kt are left on our roads each year—and end-of-life.)

And finally, tyre recycling gives a powerful spin to the green employment revolution: 9.2 jobs are created for every 10,000 tonnes of waste recycled. In 2017, tyre-recycling businesses employed around 250 people, but that was pre–National Sword policy. Current figures are hard to come by, but ATRA lists eight firms as members and notes that together they recycle around 400,000 tyres per week, 95% of Australia’s tyre-recycling activity.

Are there drawbacks to recycling tyres?

The nature of tyres means that wherever they are, the environment suffers. Many of the reuses of rubber granules, buffings and crumb will continue to leach chemicals and microplastics throughout their afterlives. The additive 6PPD-quinone, known for its toxicity to salmon and trout, was identified in an Australian first in a creek near Brisbane’s M5 motorway in late 2020.

This problem was exacerbated by exporting such a large quantity of tyres in the pre-National Sword years, because the exporting process inevitably involved stockpiling large numbers of tyres until a ship was ready to receive them. Some readers may remember the infamous Stawell dumping ground in western Victoria, where around 1 m tyres were held at a site only 2.5 km from the town’s CBD and just 300 m from its biggest employer … an abattoir.

Such an enormous number of tyres so close to the town posed an insane fire risk, not to mention a breeding ground for rats and mosquitoes. Any fire on the property would have released hazardous gases, heavy metals, smoke and oil, and resulted in pollution to air, land and water. The result would have necessitated evacuating the town’s entire population—some 7000 people at the time.

And Victorian authorities had good reason to be scared of a tyre-dump fire. On 28 October 1989 arsonists lit a fire at an even larger tyre dump in Heyope, Wales, where around 10 m tyres had accrued in a dingle (a deep wooded valley) over two decades. The blaze took 10 days and two fire brigades to control—but the dump didn’t actually stop smouldering until 2004, a full 15 years later. For that entire time, phenols, cyanide and polyaromatic hydrocarbons were being released into the surrounding area, including the local brook.

Thankfully no such fire broke out in Stawell, and the site was taken over by the Victorian EPA in 2017. In a clean-up costing around $5m and lasting nine weeks, the EPA removed almost 10 kt of tyres. While the Stawell dump’s owners clearly behaved reprehensibly in terms of their environmental, social and corporate responsibilities, it was standard practice at the time to collect, stockpile and ship our wasted wheels abroad. The situation may have looked quite different had Australia ensured access to local recycling infrastructure, instead of needing China to shock the bejeezus out of us before doing so.

Image: Ramzihachicho/iStockPhoto

How do we recycle tyres in Australia?

Because the COAG export ban only came into effect in December last year, it’s impossible to find out exactly what’s going on with tyres right now. But nevertheless, there is interesting information to be gleaned from what we do know. The first thing to note about the figures for 2018-19 is that while most of our passenger and truck tyres were sent offshore, the vast majority of OTRs remained here: a total of 96 kt, which accounted for 90% of OTRs and 46% of the total amount of tyres processed locally.

So what happened to them? The answer is that they went straight to mining-industry “onsite disposal” facilities. The report is silent on exactly what this disposal involves, but given we’re talking about the mining industry here, it’s probably safe to assume that the tyres weren’t recycled into fairies and unicorns—in the history of industrial Australia, we have buried or landfilled at least 10 Mt of tyres, and industry tosses 80 kt of conveyor belts, rubber tracks and other products per year.

Setting aside the tyres that disappeared into the mining industry’s facilities, we’re left with around 112 kt of worn-out rubber processed domestically in 2018-19. A whopping 34 kt of that amount ended up in landfill. Roughly equivalent amounts were split between use as casings and seconds (32 kt) and as crumb, granules and buffings (33 kt); the rest went to civil engineering (3 kt), stockpiles (5 kt) and dumping (5 kt).

In summary: in the last year for which we have reliable figures, Australia processed 208 kt of tyres onshore. Of that total amount, 46% ended up in the mining industry oubliette, another 16% went to landfill, and 2% was just flat-out dumped somewhere. This means that only about a third of the tyres processed locally were actually recycled. We need to do better.

Perhaps in recognition of this fact, the the CSIRO was commissioned to look into circular economy processes for a variety of recyclables. The resultant report—entitled A Circular Economy Roadmap for Plastics, Tyres, Glass and Paper in Australia—was published in January 2021. The document gives comprehensive information on the issues facing tyre recycling (ranging from the lack of quality controls and import levies, to the long transport distances and infrastructure costs) and the opportunities for driving a circular economy (from avoiding and reducing consumption, to increasing and diversifying recycling, remanufacture and reuse). It also repeats and expands on recommendations made in the 2018 National Market Development Strategy for Tyres—so clearly, it’s not ideas that have been lacking. Rather, it’s implementing those ideas that has been a problem.

So how has implementation been progressing? The rhetoric, at least, has been positive: the Morrison government is trying to reimagine Australia as a Great (Re)Manufacturing Nation. As far as actual, tangible policies go, though … well, there’s the campaign ReMade in Australia, with a well-presented website that is pretty slim on information. There’s also the Recycling Modernisation Fund (RMF), contributing $190 m itself while “leveraging over $800 m of recycling infrastructure investment from states and territories and industry”.

According to the Fund’s website, it “will create approximately 10,000 new jobs and divert over 10 m tonnes of waste from landfill”. How much of this 10 m tonnes will be tyre waste is uncertain: based on the grants allocated as of January 2022, only one tyre project will be finished by February 2022 (in Victoria), with others opening their doors in June, December and then into 2023. Not all states are represented in the federal tyre grants, and between this and the slow roll-out, we can assume that nice healthy tyre stockpiles are growing across the nation.

There is one very visible result of the sudden need to process tyres locally, though: a proliferation of Australian companies betting on the potential and variety of TDMs. Universities and private companies have been working on sub-sea pipeline protection, road base, brake lining, wheelchair ramps, speed humps, tile adhesives, permeable pavements, asphalt, gravel substitute, filters for waste water treatment, woven tyre mats for cattle, and a bewildering variety of other potential use cases. Many of these ideas apply to areas controlled by local councils (e.g. 85% of roads), so strong industry–council relationships will need to be established and maintained to make them a success.

A rapidly growing number of new pyrolysis plants have been opening in anticipation of a sudden glut of passenger and OTR tyres. Existing plants are also expanding their operations: the long-running Green Distillation Technologies (GDT) plant in the western New South Wales town of Warren doubled its capacity in early 2021. And specialist tyre recycling companies are also getting in on the act: Tyrecycle, Australia’s largest tyre recycler, has opened a new plant in Erskine Park, NSW. Once at full capacity, the new Tyrecycle plant should produce 40 kt of TDF and 10 kt of rubber crumb per year, making it Australia’s largest single tyre recycling facility. The company aims to replicate the facility in Perth by the end of 2022 in order to capitalise on the Western Australian government mandating the use of Australian rubber crumb in all new roads—a fine example of green public procurement that other governments would do well to imitate.

A key actor in tyre recycling is Tyre Stewardship Australia (TSA), a Government Accredited industry-led, voluntary stewardship scheme for Australian ELTs. It was launched in January 2014 “to promote the development of viable markets for end-of-life tyres”, and collaborated on the formulation of the 2018 National Market Development Strategy for Tyres. TSA’s member base includes tyre retailers, manufacturers, recyclers, collectors and the Motor Trades Association of Australia (MTAA). It currently has around 1700 members, who collected 246 kt of ELTs in the last financial year. Members are charged a levy starting at $0.25 per standard passenger tyre and going to $0.75 for a small agricultural tyre and $50 for a large earth-moving tyre from the mines. This funds sector advocacy, research and innovation.

One of TSA’s newest members is Molycop, which has industrialised home-grown tyre-recycling innovation. The result of research by Scientia Professor Veena Sahajwalla from the Centre for Sustainable Materials Research and Technology (SMaRT) at UNSW, Molycop collects and burns tyres in its integrated electric arc furnace (EAF) steelmaking operation. Known as “green steel” or polymer injection technology (PIT), Prof. Sahajwalla’s technique is able to recycle all kinds of tyres by replacing some coke with ELTs. (Stay tuned for a case study on Prof. Sahajwalla’s work in an upcoming article in this series!)

Despite the good work that TSA does, it has significant weak spots: of all auto brands selling in Australia, only Porsche, Volkswagen and Mercedes-Benz (representing 9% of vehicle sales) are contributors, as are nine tyre importers representing 47% of tyre sales. This incomplete coverage is, of course, a result of the scheme being voluntary rather than mandatory, a choice which is hardly strategic when Australia is trying to increase its tyre recycling so drastically.

Both the 2018 Senate report Never Waste a Crisis and the CSIRO’s 2022 circular economy roadmap called for the TSA scheme to become compulsory. Clearly this change could be an easy win for tyre recycling in Australia, and would turbodrive developments in research, infrastructure and recycling rates and effectiveness.

How does Australia compare to the world?

In 2019, the WBCSD published a study of 45 tyre-recycling countries, which represented 83.5% of vehicles in the world. Those nations collected 26 Mt of the 29 Mt of tyres which reached end-of-life during that year, with China, the US and Europe collecting the largest quantities. Argentina had a lowly 9.6% recovery rate, but China recovered 100% and India 99.8% of their tyres. In both cases, however, a significant portion was collected informally and could not be traced to its end use. The USA only recycled 81% of its rubber “tires” in 2017, while overall Europe recycles 92–95%—in both areas, almost half of this as waste-to-energy.

Finland, meanwhile, has a comprehensive national system that recycles almost 100% of motor vehicle tyres (or 55 kt) per year—a system we would do well to imitate. The country’s government established producer organisation Finnish Tire Recycling Ltd in 1995, which has reliably met its legal requirement of 95% recovery since then. For every new motor-vehicle tyre purchased, Finnish consumers pay €1.74 as a recycling fee; drivers can then deposit their ELTs at one of the 3000 collection points nationwide. ELTs are moved from collection sites to regional terminals; once around 910 t are gathered, the tyre shredding equipment is brought on-site. The reuse options prioritise retread for existing tyres, material recycling, then energy recovery, “in accordance with the principles of the waste hierarchy”. The Finnish process is so successful, according to Thomas Söderström, material manager at the national operator, Kuusakoski Oy, that it’s “an unnoticed part of the chain … easy for tyre producers, sellers and end customers alike.”

What is the future for recycling tyres?

Sadly, none of the Australian recycling systems that Renew has investigated is remotely as ubiquitous, as simple or as successful as Finland’s. But the Australian and global tyre industries already have an excellent suite of recycling solutions at their disposal—both simply must capitalise on those solutions more attentively.

Investing in a more sustainable product is one way to make a significant long-term impact on a resource hungry business; examples include replacing rubber sources (as Coopertire is trying) or recovering carbon black (as Bridgestone is doing). Systematising and quality controlling tyre design, production and recycling outputs would provide greater security for industry, while investing in effective stewardship, reliable infrastructure and supported innovation would allow tyre recycling to become routinised and sustainable in terms of materials, jobs and our planet.

Ultimately, whichever way we go about it, there’s no getting around the fact that we need a revolution: a revolution to a full circular economy for Australia’s waste.

Wait, but I’m a cyclist!

Sharp-eyed readers will have noticed that bicycle rubber has received nary a mention in the preceding article. So what about bike tyres? Where do they fit into all this?

Bicycle Industries Australia says that Australian bike retailers imported 1.55 m bikes (i.e. 3.1 m tyres and tubes) in 2021, plus 1.2 m tyres and 3.4 m tubes as replacements. This doesn’t include individual purchases online—and any recycling strategy must account for the high number of cyclists who do their own tyre and tube repairs. Australia currently has no national stewardship or recycling scheme for bicycle parts or rubber, although bike stores are interested and willing.

Peter Bourke, BIA’s general manager, says much of the difficulty lies in the fact that most of Australia’s 900-odd stores are small family businesses with very limited storage capacity, plus the fact that recyclers need a pallet-worth of rubber to make recycling feasible (a total the average store would only reach once or twice a year).

That being said, some Australian tyre recyclers—like Tyrecycle—do accept bike rubber in their recycling processes. A Melburnian enterprise called Recycle Bike Tyres, operating since March 2019, is connecting cyclists, retailers, repairers and councils city-wide with Tyrecycle. Recycle Bike Tyres builds and supplies collection bins to partners, which they fill up with tyres and tubes (charged at $2 per tyre and $0.50 per tube). The bins get emptied every four to six weeks and taken for recycling as tyre crumb. The company is also making forays into regional Victoria and has so far recycled 32,888 tyres and 44,000 tubes, diverting a total of 24.78 t from landfill.

As a national example, we could copy Britain’s National Bicycle Tyre Recycling Scheme, launched in September 2020. The scheme, managed by specialist bike tyre recycler Velorim, promises no landfilling, no overseas dumping and no carbon released from its recycling process. The scheme allows cyclists to take their leaking tubes and busted tyres to a collection centre, where they pay £0.25 per tube and £0.55 per tyre. Not only does the company collect and recycle centrally, it has also been conducting its own R&D since 2018. Velorim doesn’t yet cover all of Great Britain and its 8.3 kt per year of wasted bike rubber, but it’s made a great start.

Some bike-tyre manufacturers, such as Germany’s Schwalbe, have also established greener manufacturing systems. It offers tube collection to all bicycle retailers in Germany, the Netherlands and Great Britain, vulcanises and recycles them in its Indonesian factory, and uses the recycled rubber as 20% of its new tubes. Even taking those enormous transportation distances into account, it consumes only 20% of the energy used in virgin-rubber tubes. Tubes of new material consume 64 MJ/kg of energy, but the recycled tubes use only 12.4 MJ/kg.

Both Vredestein and Continental have invested in Taraxagum, developed from the rubber of dandelions grown near their European manufacturing plants. It now makes up around 30% of Continental’s bike and car tyres, including its Urban Taraxagums for bikes. (Continental is also working to replace the synthetic fabric in its car tyres with recycled PET bottles.)

Meanwhile, bike manufacturer Trek is working on reclaiming both rubber and carbon black in its tyres, as well as producing an array of bike accessories from reclaimed plastic waste. For those who really appreciate the detail, Trek has also completed the world’s first sustainability assessment of all stages and components in the bike biz. The exact numbers vary from bike to bike, but generally rear and front wheels rank as the second and third highest emitters, behind frame assembly.

Of course, there’s also the fact that by cycling, you’re not driving, and thus saving a whole heap of emissions by the simple fact of not being in a car. As a rule of thumb, if you ride 692 km that you would have driven, you’ve saved the carbon it took to make your bike. Everything after that is a net benefit to the world. — Jodie Lea Martire

Resources:

Bike tyre recycling near you

recyclingnearyou.com.au/tyres

Trek sustainability report

bit.ly/3tJNZUp

Further reading

Reuse & recycling

Reuse & recycling

Community eco hub

Nathan Scolaro spends 15 minutes with Stuart Wilson and Michael McGarvie from the Ecological Justice Hub in Brunswick, Melbourne.

Read more Reuse & recycling

Reuse & recycling

Recycled hydronic heat

Renew’s sustainability researcher Rachel Goldlust gives us a view of and from the Salvage Yard.

Read more Reuse & recycling

Reuse & recycling

The future of packaging

Packaging comes with just about everything we consume, with far-reaching implications for us and the planet. Jane Hone asks how we can get a handle on it.

Read more