Transition delayed

A recent plan by the energy market operator shows that a 90% renewable grid is entirely feasible. But there are roadblocks delaying the transition. Andrew Reddaway analyses the plan and issues.

The electricity sector is the most critical sector in the fight against climate change. It currently accounts for around 34% of Australia’s greenhouse gas emissions due to its reliance on fossil coal and gas. Post a major switch to renewables, the electricity grid will allow other sectors (such as transport and heating for buildings) to clean up their energy source via electrification.

In 2018–19, 21% of the electricity flowing into Australia’s main electricity grid was generated from renewable energy. This is a good start towards achieving a fully renewable grid, but there’s still a long way to go.

In addition to the obvious political obstacles at the federal level, the transition to renewables is being delayed due to an outdated electricity market design that’s failing to deliver for Australians.

Enter AEMO’s Integrated System Plan

In December 2019 the Australian Energy Market Operator (AEMO) published its 2020 Integrated System Plan (ISP) in draft form. AEMO has always played a role in transmission planning, in addition to operating the short-term wholesale market. The ISP arises from a 2017 recommendation by the Chief Scientist Alan Finkel.

The ISP confirms other researchers’ earlier analysis which found that the most economic option to replace our ageing coal-fired power stations is wind and solar, supported by energy storage and new transmission. These assets are relatively capital-intensive, but operating costs are low because their fuel is free. Over a multi-decade lifespan, those future savings become significant.

AEMO can’t force generators or retailers to build or close assets in line with the ISP. However, AEMO may soon gain the power to direct development of new electricity transmission lines which it has found necessary via this planning process. This is an important step to accelerate these new connections.

Step Change—90% renewable by 2040

AEMO modelled five scenarios varying according to many factors including economics and technology uptake. The most interesting is named Step Change and is designed to be compatible with Australian decarbonisation by 2050. In other scenarios such as Central, coal-fired power stations are still replaced with wind and solar, but more slowly since they’re retained until end-of-life.

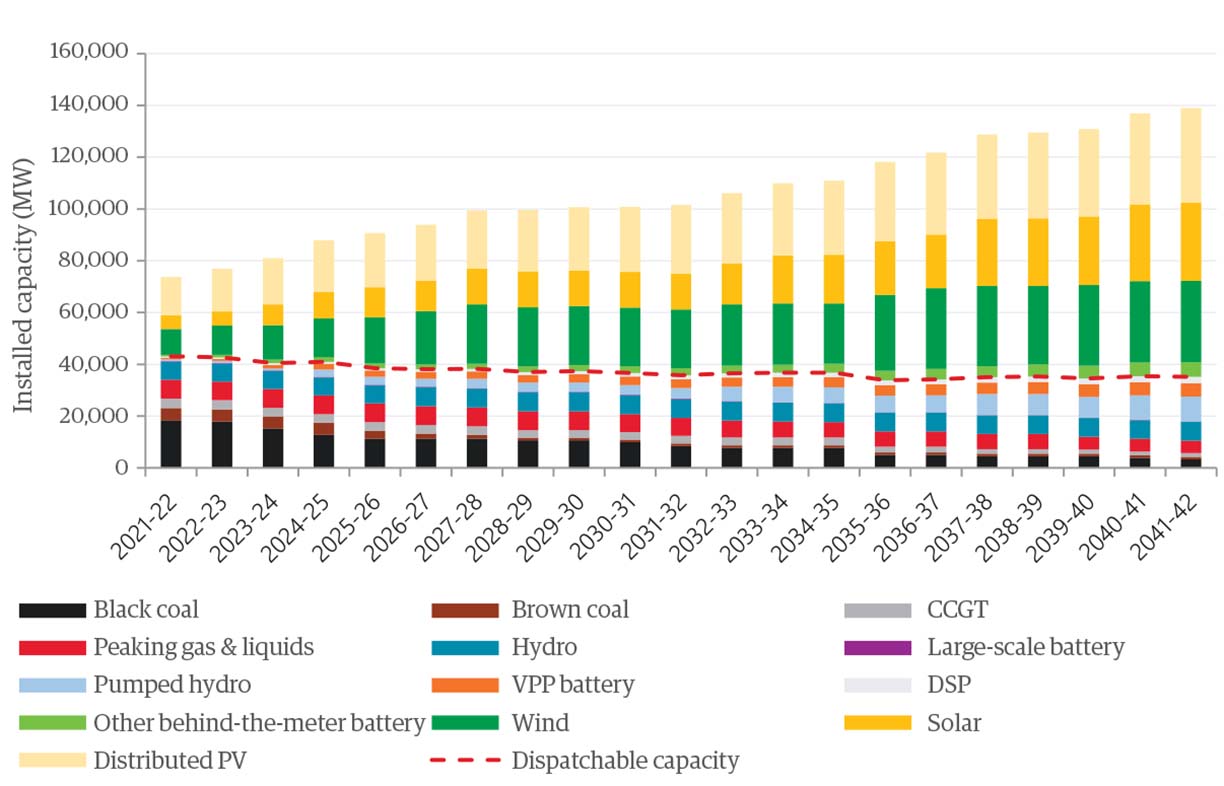

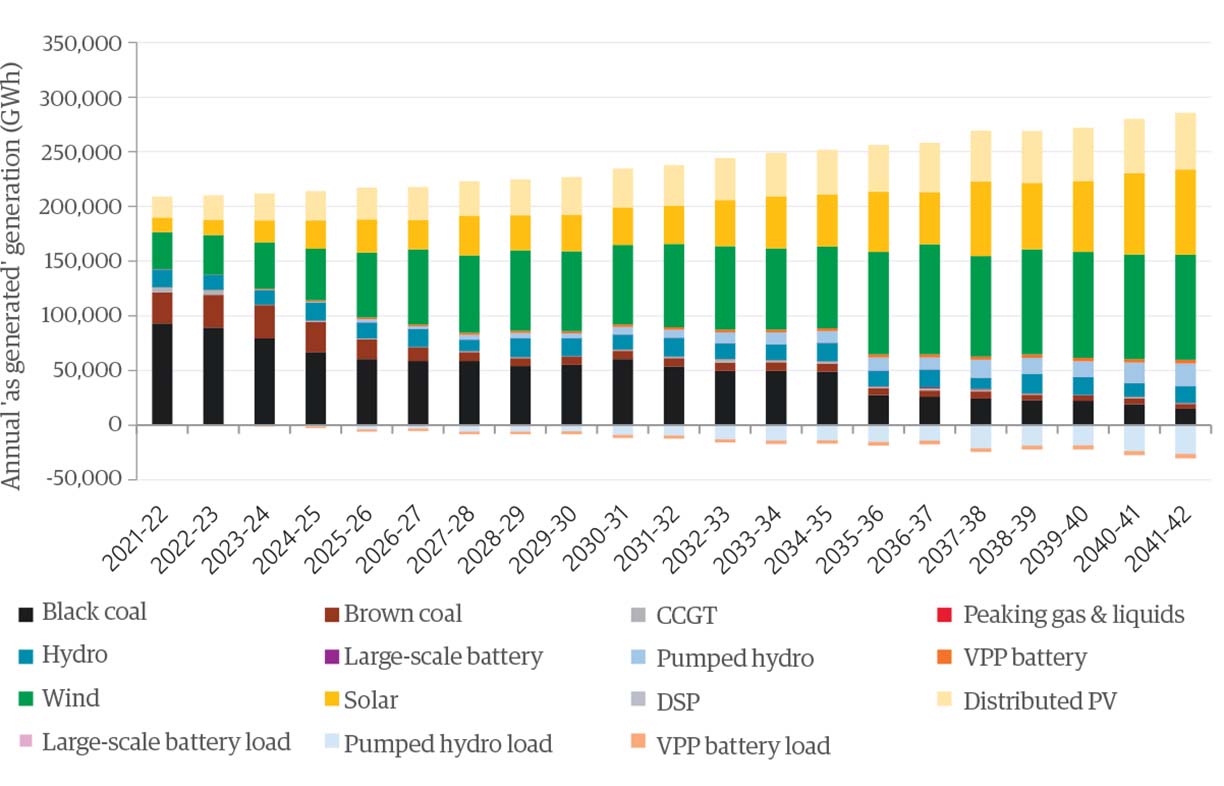

In the Step Change scenario, by 2040–41 fossil fuels decline to 8% of total generating capacity and 10% of annual electricity generation. Greenhouse gas emissions fall to 15% of their value in 2018-19.

By 2040–41, wind and solar farms each total around 30,000 MW of installed capacity, while rooftop solar is around 35,000 MW.

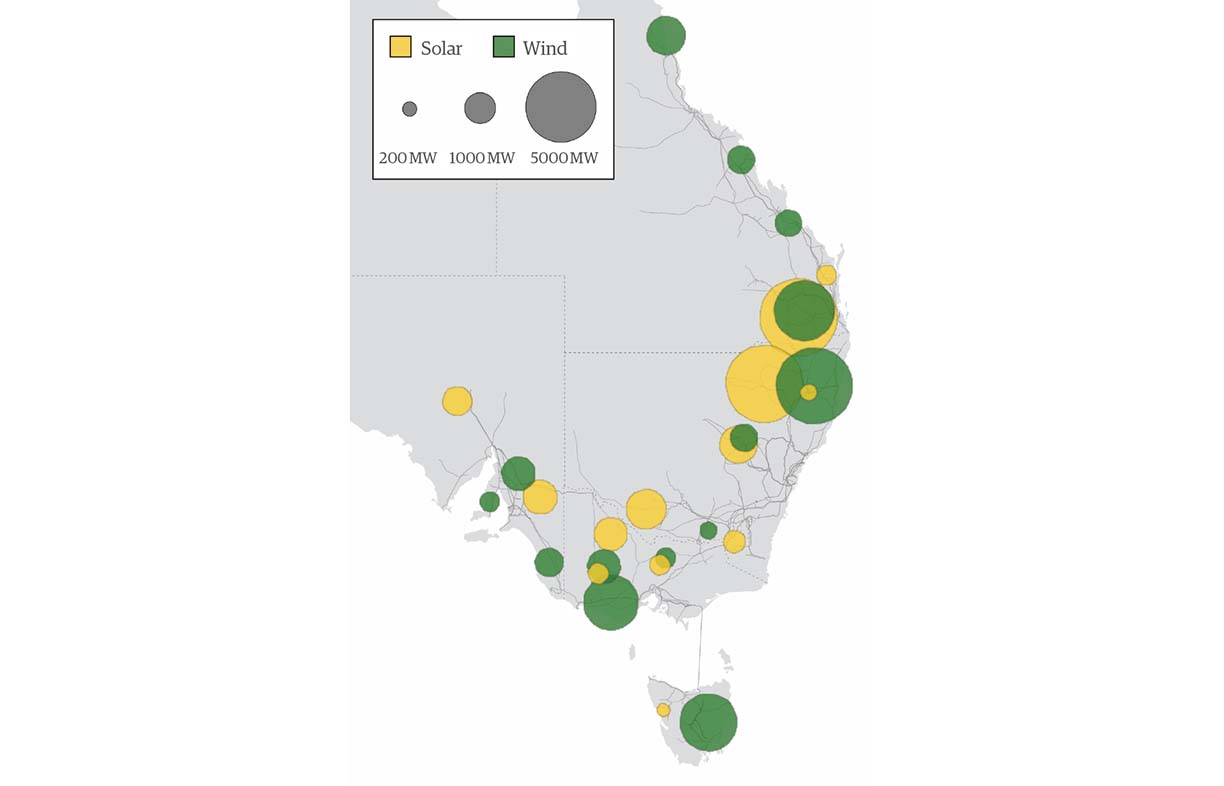

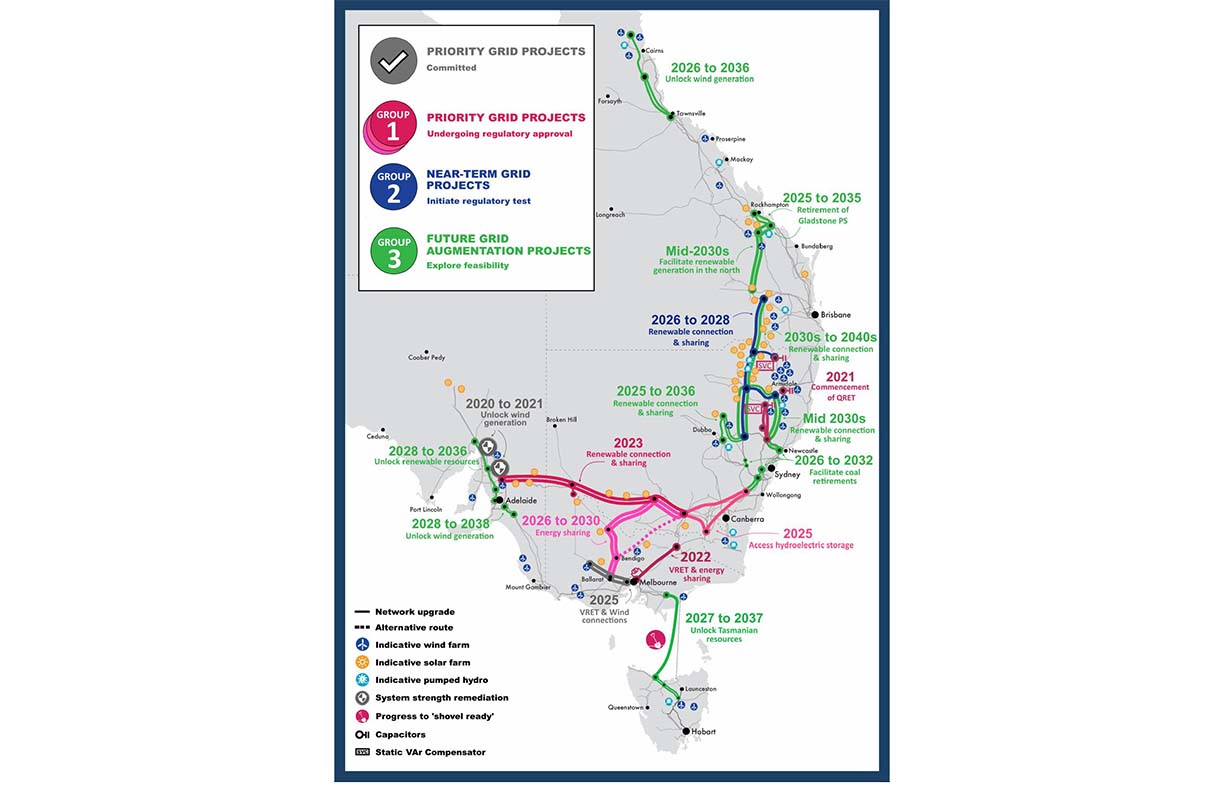

As shown on the map in Figure 1, north-east NSW and south-east Queensland become renewable powerhouses and Tasmania exports a lot of wind power. Victoria frequently relies on renewable energy from its neighbours, transmitted via interconnectors.

Figures 2 and 3 detail future growth in generator capacity and annual generation. Generation in GWh increases over time to meet growth in electricity consumption. Generator installed capacity grows even faster, because wind and solar usually don’t generate as much of the time as coal units.

Energy storage for Step Change

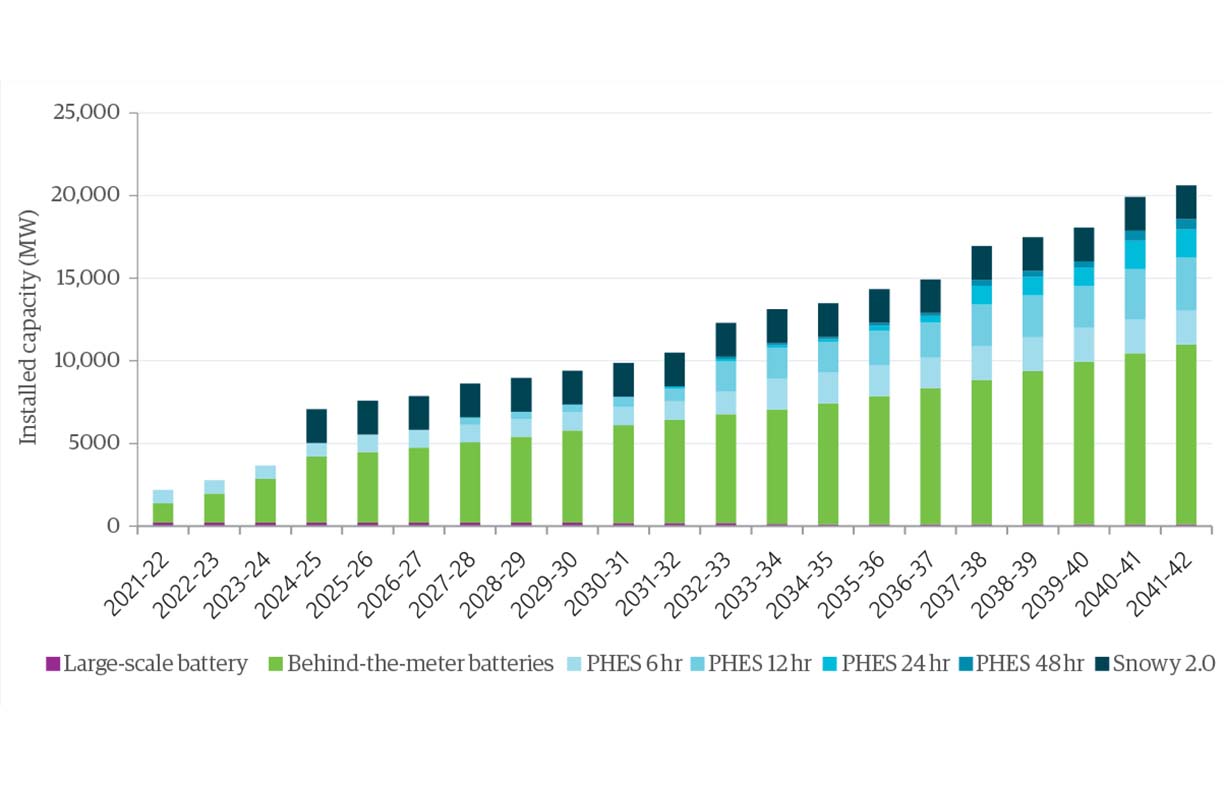

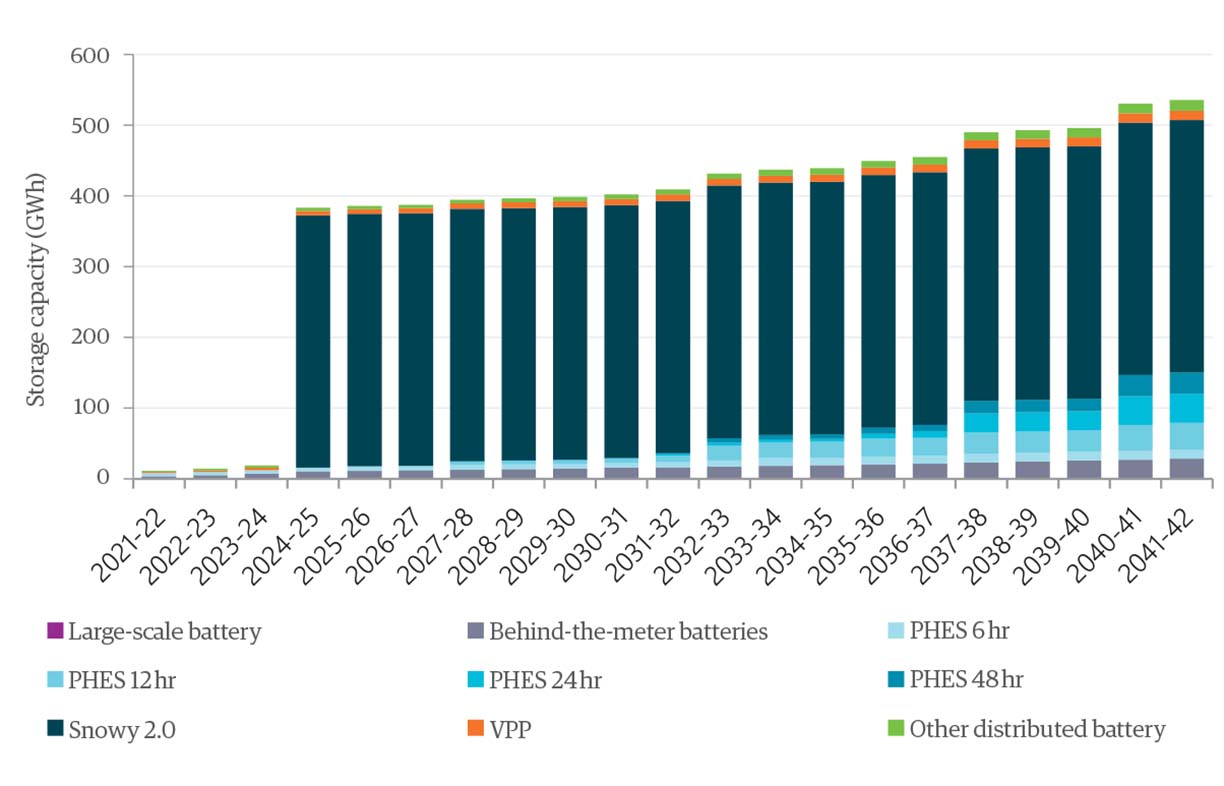

The high levels of wind and solar in AEMO’s Integrated System Plan require lots of energy storage to cover nights, cloudy periods and ‘wind droughts’. For this energy storage, Figures 4 and 5 show the installed capacity in MW and storage capacity in GWh.

In terms of energy storage capacity, Snowy Hydro 2.0 dominates thanks to its very large, pre-existing water reservoirs. This facility will be able to generate as much power as a coal-fired power station (2000 MW) for a whole week. It’s a prime example of ‘deep’ energy storage able to handle prolonged periods of cloud or low wind.

Batteries and small pumped hydro facilities are examples of ‘shallow’ energy storage; when run at full power, they deplete relatively fast, e.g. in six hours or less. This is very useful to store solar energy from daytime to use at night. These facilities provide most power capacity in the Step Change scenario. AEMO expects that these will already total more than 2000 MW of capacity by the time Snowy Hydro 2.0 is commissioned in 2024–25.

Average demand for electrical power in the NEM is about 23,000 MW. The 90% renewable Step Change scenario has a total energy storage capacity of 531 GWh. This is enough to supply the average NEM demand for around 23 hours in the absence of generation. For comparison, a study by ANU estimated that 490 GWh of energy storage would be enough for a fully renewable grid.

Energy storage must be well-coordinated. For example, during a winter afternoon peak it may be wise to discharge deep storages rather than shallow ones, leaving all storages partially full to supply a larger evening peak. In the present market, private operators will be tempted to fully discharge their storage any time the wholesale price is high, in an uncoordinated way.

Scenario costs

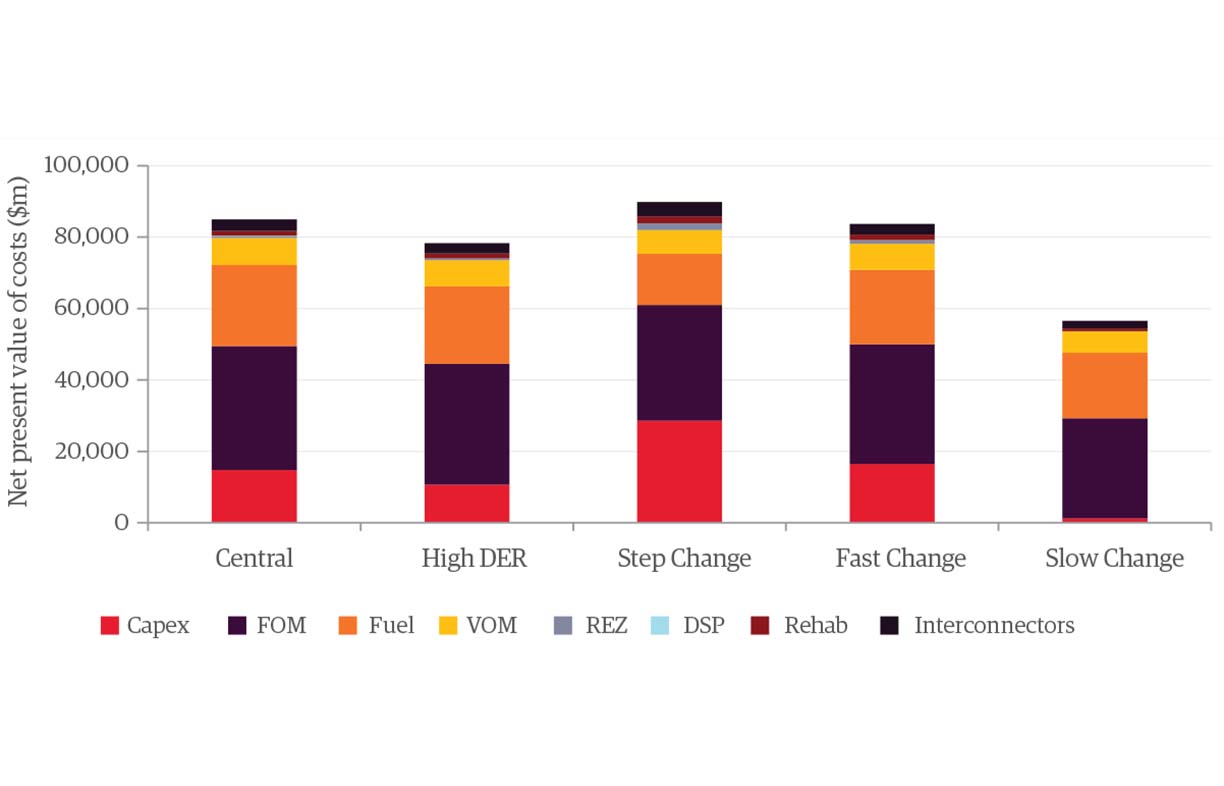

The Integrated System Plan doesn’t talk much about the overall costs of its scenarios, but it does outline them in an appendix. For each future year from 2021–22 to 2041–42, AEMO estimated how much money would be spent in the electricity grid considering capital expenditure, maintenance, fuel etc. Excluded from these figures are spending in the distribution network and investments by consumers in solar and batteries.

Not included are any costs arising from greenhouse gas emissions or direct health impacts. To deal with inflation, AEMO used constant real 2019 dollars. It then calculated a net present value (NPV) by discounting future year costs by applying a discount rate of 5.9% (or 7.9% for the Slow Change scenario).

Figure 6 collates the net present value of future grid costs. On this measure, Step Change costs about 6% more than the Central scenario. Due to the NPV methodology and exclusions, the magnitude of costs is not particularly meaningful and doesn’t represent the cost to consumers, but the percentage difference may be informative. From a whole-of-society point of view, paying 6% extra for the electricity grid seems like a great deal given the benefits to national fuel security, jobs, direct health impacts and greenhouse gas emissions. It’s interesting how cheap interconnectors and transmission are (the top black bar) compared to other items.

The Slow Change scenario costs dramatically less than Central, but this is explained by several factors. Slow Change’s higher discount rate is significant; for example, a cost incurred in 2040 is discounted by nearly 80% compared to a discount of only around 70% for the other scenarios. The Slow Change scenario is based on a stagnant economy, industrial closures and relatively cheap gas prices. Electricity consumption in 2040 is about 17% lower than Central or Step Change. All these factors work to artificially suppress costs for this scenario—it’s not an ‘apples to apples’ comparison.

Pumped hydro in Step Change

Energy storage is essential to support a predominantly renewable energy system, and pumped hydro is the frontrunner. In AEMO’s Step Change scenario with a 90% renewable grid, pumped hydro accounts for about 88% of energy storage in GWh, and about 47% of capacity in MW.

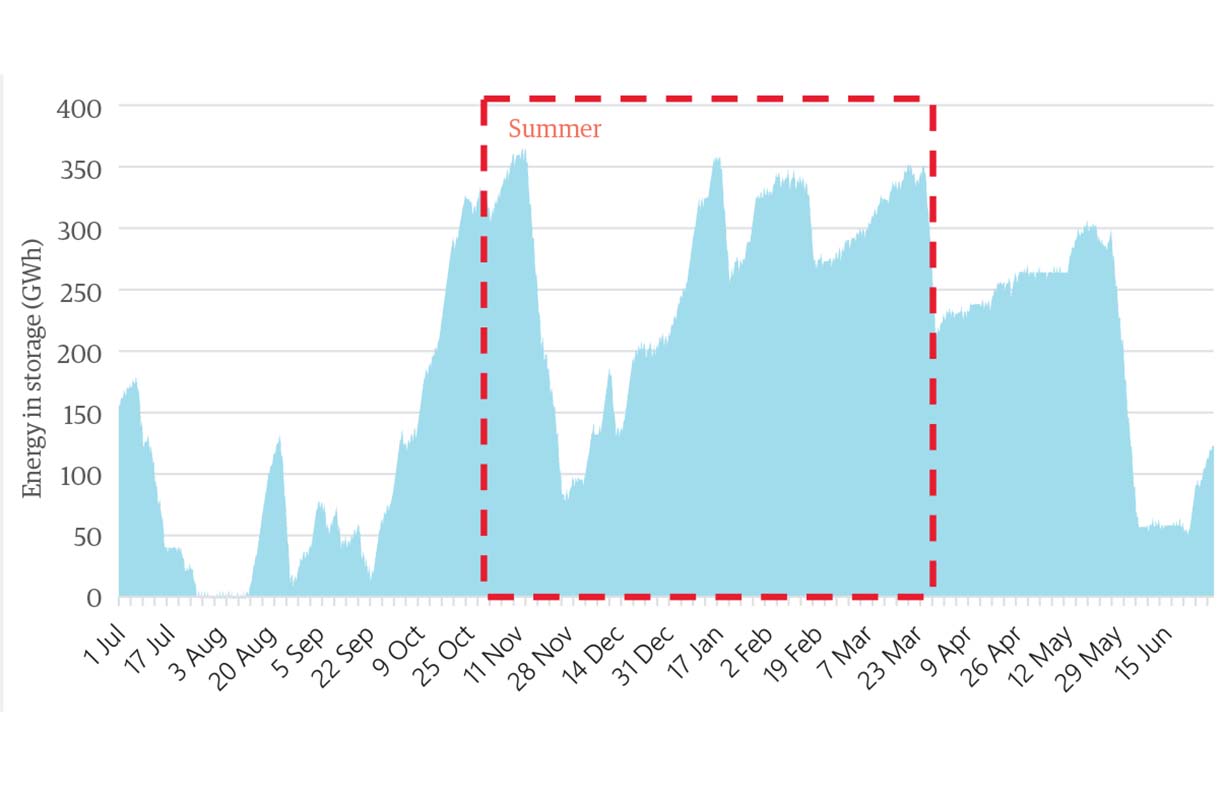

Snowy Hydro 2.0

An important question for Snowy Hydro 2.0 has been: “Is that much deep storage even useful?” AEMO’s draft ISP provides an answer in the chart in Figure 7, simulating its energy storage levels over the year 2039–40. SH2 is fully cycled during the year and is partially cycled several times. This demonstrates that SH2’s large energy store is useful; if its dams were smaller, the grid would have required extra energy storage, or more fossil fuels would have been burned. Note that this graph is for the Central scenario; Step Change would tend to use SH2’s deep storage even more.

According to AEMO, SH2 is necessary for the grid to follow the Step Change scenario. AEMO’s analysis also assumes perfect foresight. In the real world SH2 provides an important buffer to cover operational errors.

SH2 has been criticised for the project’s expense (approx. $4 billion). There are many ways to assess this cost, but a simple method is to compare it to home solar batteries such as the Tesla Powerwall 2 (PW2). Delivering SH2’s energy storage capacity in GWh would require every Australian household (including apartments) to install 2.6 PW2 batteries at a cost of about $39,000 per household. In contrast, SH2 costs about $400 per household. The PW2 option does provide much more power (10 kW per household compared to 0.2 kW) which is great for supplying peaks, but not essential for the seasonal storage at which SH2 excels. Another factor is longevity; home batteries are expected to last 10 years, while SH2 should still be operating a century from now. For further debate on SH2’s merits, see an essay by Bruce Mountain (bit.ly/2ICD1HS) and Snowy Hydro’s response (bit.ly/333uurb).

Some people have been concerned that much of SH2’s pumping energy will come from coal rather than wind and solar, propping up the economics of fossil fuel businesses. In the short term this is partly true, but this is a transitional arrangement necessary for system reliability. While new assets are being built, coal-fired power stations will still be required to supply evening peaks. They can turn down their power to say 30% or 50%, but they can’t switch off and on every day. For a few years we’ll have a daytime oversupply of electricity, so it makes sense to store rather than waste it.

Once the transition is further advanced, SH2 will charge from renewables.

Battery of the Nation

Like Snowy Hydro 2.0, Hydro Tasmania’s Battery of the Nation (BOTN) project can deliver huge amounts of hydroelectric energy mostly via existing reservoirs. Tasmania is powered largely by traditional hydroelectricity, which has the capacity to ‘firm up’ large amounts of wind power. The broad idea is that when the wind’s blowing, some hydro generators can switch off, conserving rainwater stored in Tasmania’s high reservoirs. This extra stored water is then available to power Tassie as usual when the wind’s not blowing, and to export firm power to the mainland via the proposed Marinus Link, which would be the second Tas–Vic interconnector. Specifically for BOTN, three pumped hydro projects in Tasmania are proposed, which will enhance the Tasmanian hydro system’s operational flexibility and peak power.

AEMO has found that for the Step Change scenario, BOTN and Marinus Link are necessary, and its first phase should be progressed as soon as possible. This phase provides a single submarine cable to Victoria.

Pumped hydro facilities sometimes share reservoirs used by traditional hydro facilities. In this case their operation must be well coordinated for irrigation and environmental flows etc. Hydro Tasmania and Snowy Hydro are very experienced in this area.

What else is needed in the ISP?

Renew is pleased to see that AEMO has confirmed that a 90% renewable grid is achievable. On the other hand, AEMO hasn’t yet described in detail how this system supplies energy through a very unfavourable week, for example when it’s cloudy and calm. How deeply are energy stores depleted? In consultation sessions with AEMO, Renew has pushed for this detail to be provided; without this, it’s inevitable that some commentators and policy makers won’t believe that a 90% renewable grid can be reliable.

AEMO hasn’t looked at hydrogen in this draft ISP. One way to further reduce fossil fuel burning is to use excess wind and solar generation to produce hydrogen (or derivatives such as ammonia) and store it for weeks or months until it’s needed to generate electricity again. Inclusion of such processes would increase the proportion of renewable electricity above 90%, potentially to 100%. This is a relatively simple extension of the Step Change scenario, so we hope that AEMO will examine this in future.

Renew also advocates for the transition to renewable electricity to be completed earlier than 2040. Hopefully, in the future AEMO will examine the feasibility of more rapid decarbonisation.

Can the current energy market deliver the Step Change scenario?

Wind and solar farms are quite different to fossil fuel generators and their large-scale uptake wasn’t anticipated when the national electricity market (NEM) was created in the 1990s. They cost very little to run but their generation is variable or intermittent depending on weather conditions.

Their generation is not ‘firm’—in other words, they’re not dispatchable. For a reliable high-renewable grid, energy storage is required to deal with this variability, to ‘firm them up’. New transmission lines are also required to connect them to the grid.

The current market is failing to construct energy storage and transmission in pace with wind and solar generation—instead these components are lagging and delaying the transition to renewables. Here are some of the issues.

Refreshing the fleet is tricky under the NEM

When the NEM was established, it inherited from the previous state commissions a large fleet of coal-fired generators mostly built in the 1970s and ‘80s.

This gave the new market a few decades of ‘smooth sailing’ as over this time relatively minor changes were needed. Distribution networks were upgraded and new gas-fired power stations were built to meet air conditioner driven demand peaks.

These were tasks to which the NEM’s market structure was well-suited. For example, even though a gas-fired generator runs only infrequently, it can pay for itself by bidding the wholesale electricity price up to 160 times its regular level.

Even without a shift to renewables, the NEM faces a challenge that it’s never seen previously—a refresh of its main fleet of generators which are reaching the end of their lifespan and closing. Like an old car, an old coal-fired power station’s equipment (such as boilers) reach a point where further repairs become uneconomic.

AEMO has estimated that of current coal-fired generation capacity, 19% will be gone by 2030 and 63% by 2040. Various people including power station owners have warned that closure may occur sooner than estimated, due to irreparable breakdown or market conditions. AEMO is developing contingency plans for the Yallourn brown coal-fired power station to close in 2026–27, instead of its assumed phase-out from 2030 to 2033.

This refresh would have been tricky even under like-for-like asset replacement. The market has no way to coordinate the closure of one company’s generator with the construction of one by another company.

After the experience with Hazelwood, a new market rule came into effect in November 2018 requiring power stations to provide three years notice before closing. This goes against the original competitive market theory and is still problematic: three years is long enough to build a wind farm or solar farm, but not to construct essential supporting facilities such as transmission and pumped hydro.

If a coal boiler breaks down irretrievably, the power station will be out of action long-term regardless of what the rule says. And if changes in the market make a generator uneconomic, it seems unreasonable to force the private owner to operate it for three years at a loss.

Energy storage isn’t sufficiently incentivised

The NEM’s current rules have suited wind farms and solar farms because they earn the wholesale price when they generate and incur no penalty for being unavailable when the weather is unsuitable. They have also benefitted from payments under the Renewable Energy Target, but over the next few years those payments are expected to reduce to almost zero, so they now play little part in investment decisions.

On the other hand, the current market does not suit large-scale energy storage. Batteries installed in the past couple of years such as Hornsdale Power Reserve (the original Tesla big battery) in SA have earned a good financial return from acting like shock-absorbers to stabilise the grid during sudden events such as transmission lines blowing over. Their ability to instantly charge or discharge is very useful here. But there’s only a small market for such services, and it’s already nearly saturated. To ‘firm-up’ wind and solar, a high-renewable grid must store a significant fraction of a state’s power for hours or days, and this requires facilities hundreds of times larger than Hornsdale.

Under current market rules, an energy storage facility providing regular ‘firming’ services would be compensated only via the wholesale price for electricity. For example, it might charge up around midday when excess solar generation has depressed the price to $30 per megawatt-hour (MWh) and then discharge during the evening peak when the price is $120/MWh. By buying low and selling high, the owner earns $90/MWh. Such returns are insufficient to attract investors because energy storage is relatively expensive to build relative to wind and solar and some energy is lost during charge and discharge. Also, owners don’t know whether other energy storage facilities will be built, pushing up the midday electricity price due to competition.

The real value of large-scale energy storage is to enable the construction of high levels of cheap wind and solar by firming-up its generation. However, this value is not rewarded by the present market. Developers and investors have no responsibility for the grid’s overall reliability, so they naturally build the profitable part of the new system (wind and solar) and ignore the unprofitable, risky part (energy storage).

Energy storage is also hampered by specific market rules that didn’t anticipate a facility that could both draw from and inject electricity into the system. The NEM requires a connection to be registered either as a generator or a consumer but not both. A solar farm might include a battery to store midday energy and enable the owners to generate later into the profitable night-time peak. However, this battery must have its own grid connection installed since it’s not allowed to share the solar farm’s connection to the grid.

Continued delays in large-scale energy storage will eventually discourage renewable energy, especially solar farms. Between paddocks and rooftops, solar is supplying an increasingly large portion of daytime demand for electricity, which depresses the daytime wholesale price for electricity. Lower wholesale prices will reduce future solar farm revenue, which investors will anticipate causing project delays or cancellation. However, if we can ensure that energy storage is installed in step with renewables, it will charge up during the daytime, increasing the daytime wholesale price and providing a stable market for solar.

Existing transmission is inadequate

Most electricity transmission lines were built by the former state-based commissions to transport electricity from fossil fuel and hydroelectric power stations to consumers. Very strong connections exist to coal-mining centres such as the Hunter Valley and Latrobe Valley. In contrast, high-quality wind and solar resources exist in locations such as western Tasmania, rural South Australia and west of the Great Dividing Range. Over the last several years, these areas have gone from backwaters of the grid to regions of intense activity and interest by renewable energy investors and developers.

Areas with strong renewable resources are generally served by old, weak transmission lines insufficient to serve existing and forthcoming wind and solar farms. A clear example is north-western Victoria which is served by transmission lines running from Ballarat to near Mildura in two paths, one west via Horsham and one north-east via Bendigo. The shape of these lines combined with the experience of some renewable developers has led to this region being called the ‘Rhombus of Regret’.

In this part of Victoria, some solar farms have recently been forced to halve their generation because of unforeseen technical problems in transmission lines. AEMO has warned that new wind and solar farms will have to wait until new transmission is constructed. Developers have faced long delays and unexpected technical requirements. Interestingly, these issues were anticipated in an inquiry a decade ago. In South Australia, around 3% of wind farms’ generation is curtailed and wasted because they’re generating more electricity than the grid can cope with.

AEMO estimates that across the eastern states, the existing transmission network can support additional wind and solar rated to only 13,000 MW, much less than the 30,000 MW that may be required to 2040.

Cuts to wind and solar revenues

Congestion in these old transmission lines has caused revenues from many solar and wind projects to be unexpectedly slashed. At times when the line is heavily loaded, a higher proportion of energy is wasted as heat. The generator is penalised for this wasted electricity via a percentage called a marginal loss factor (MLF).

For example, in a half-hour interval Ararat wind farm may deliver 100 MWh of energy into the line, but it is only paid for 90.38 MWh because its MLF for 2019–20 is 90.38%. This is a big drop from the previous year, when it would have been paid for nearly 97 MWh. Sudden drops in MLF can even affect generators that were installed a decade ago if new generation connects nearby.

Developers cannot predict such drops in revenue even in the short term, because market confidentiality rules prevent the transmission line’s owner or manager from informing them about other planned projects. Naturally, investors are wary of committing to projects subject to such unpredictable future revenue reductions.

Last-minute extra costs

Some solar and wind farms have been required by AEMO to install extra equipment—synchronous condensers—shortly before project completion. These large spinning machines help ensure that the transmission line’s safety switches can operate properly in the event of a fault, such as towers blowing over. Such equipment is only required at generators if the local transmission line is weak electrically. A more robust, well-planned system would have less need for such equipment and would likely place them at more strategic locations. And, if planned and designed well, big batteries may be able to provide this service in addition to their other benefits to the energy system.

Generator bids in a high-renewable future

Looking ahead, it is unclear whether the current market can manage a high-renewable grid on a short-term basis. AEMO relies on generator bids and instructs the cheapest generators to supply the market. The most expensive bid required to meet demand sets the wholesale price for everyone.

Once they are built, wind farms and solar farms are very cheap to run since their fuel is free. These generators are typically willing to accept any price down to zero, because any revenue is better than none. In a fully renewable grid, much of the time the wholesale price may be zero because wind and solar alone can supply demand. At other times, other generators would be operating such as energy storage, hydroelectric or biofuels. Since these generators would only run occasionally, they might need to bid high prices to cover their annual costs.

A wholesale price that frequently jumps from zero to high levels is not conducive to a stable market and may not allow the market operator to sensibly schedule generation. For example, when there’s an oversupply of wind and solar, it’s not clear how AEMO would pick which ones to run.

New transmission is lagging

New transmission lines are required to serve the upcoming wind and solar farms. AEMO has identified the projects to achieve this, as illustrated in Figure 8. Unfortunately, none of these projects has yet broken ground. The SA–NSW interconnector was approved by the Australian Energy Regulator in late January 2020, but must pass further approval hurdles.

This transmission shortfall shouldn’t have occurred because the current amount of renewable generation was anticipated in 2009 when the Renewable Energy Target was set at 45,000 MWh by 2020. With a coordinated planning process, generator locations could have been anticipated and serviced proactively.

What about market reform?

All market bodies for the NEM (see box for a list of these and what they do) now recognise that the electricity system is in a transition and the market structure and rules need reform. However, there is some disagreement on the substance of those changes.

Comprehensive market reform

The main initiative to reform the market is the Energy Security Board’s Post 2025 Market Design for the NEM. This is quite a fundamental review, as, in addition to competitive market designs, it will also consider centralised planning approaches and more active roles for governments. Governance of the electricity system is not within the scope of the review. The project’s assessment framework includes items such as cost and reliability, but not greenhouse gas emissions, with the exception that the new arrangements should be “robust to possible future government policy changes.”

The Energy Security Board aims to identify options by early 2020 and recommend changes required to deliver a long-term, fit-for-purpose market framework by the end of 2020. Details will be finalised in 2022.

Transmission reform: COGATI and MLFs

Electricity transmission has the most urgent need for reform. The present system has failed to construct lines to serve generation that’s being constructed. Investors are walking away or incurring higher costs, raising the cost of electricity for consumers.

The Australian Energy Market Commission (AEMC) has initiated a project to reform electricity rules relating to transmission. Known as COGATI (Coordination of Generation and Transmission Investment), this changes how generators and energy storage facilities are paid for the energy they produce. Instead of the wholesale price, they’ll receive a local market price specific to their location. It also introduces a new market for financial transmission rights, which generators will need to purchase if they want to receive a price closer to the normal wholesale price.

The AEMC’s final report is due in March 2020; there is not yet any timeframe for implementation. AEMO doesn’t agree that COGATI should be a priority, stating that “AEMO considers it inappropriate to commit to this significant reform prior to addressing more pressing priorities in the NEM.”

In the meantime, in February 2020 the AEMC rejected a request to modify the rules on calculating marginal loss factors.

Placing reliability obligations on electricity retailers

In July 2019 electricity retailers were incentivised to purchase electricity from ‘dispatchable’ sources. This is the Retailer Reliability Obligation (RRO), and was originally introduced as part of the federal government’s former policy on energy and emissions named the National Energy Guarantee (NEG), principally designed by the head of the AEMC.

The idea is that blackouts may arise if short-term competitive market forces lead to non-dispatchable wind and solar farms replacing fossil fuels. To avoid blackouts during wind droughts and/or cloudy weather, the electricity system needs a certain level of dispatchable generators such as energy storage or fossil fuels. To ensure this level is maintained in the system, when retailers purchase energy, they are obliged to purchase a certain proportion from dispatchable generators. This would generally take the form of off-market contracts between retailers and generators.

The RRO is quite hard to understand; for more details see the useful introduction by Norton Rose Fulbright at bit.ly/2ILrqqp. One question is which generators qualify as ‘dispatchable’. For example, a shallow pumped hydro facility is dispatchable, but perhaps only for four hours until the top dam is depleted. A contract relying on this generator may comply with the RRO, but fail to avert blackouts in a severe event. Since the RRO relies on individual private companies acting without coordination, it’s hard to see how it can ensure that the overall system is reliable; financial contracts and insurance products may prove insufficient for the task.

Enabling energy storage

The present energy market doesn’t neatly allow for energy storage facilities, since there’s no category for a market participant that both draws energy from the grid and delivers energy into it. AEMO submitted a rule change in August 2019 to facilitate energy storage. The AEMC has not yet progressed this.

Another reform relevant to energy storage is the move from 30-minute to 5-minute financial settlement of the wholesale market. The smaller interval incentivises new, fast-acting technologies such as batteries and prevents market players from extracting extra profits via unscrupulous bidding practices. This change was requested in 2015 and approved by the AEMC in November 2017. Allowing for market participants to implement IT system changes and re-negotiate long-term contracts, the change won’t be implemented until July 2021.

Who’s running the energy market?

State and federal politicians direct the grid’s development via the Council of Australian Governments’ Energy Council, which consists of state and federal energy ministers. Consensus is hard to achieve and often these ministers’ actions are uncoordinated. Energy is traditionally and formally the responsibility of state governments rather than federal, but as with health and education, this demarcation has become blurred in recent decades.

The Australian Energy Market Commission (AEMC) is the ‘rule maker’ in the NEM and governs the process for changes to electricity market rules and the law.

The Australian Energy Market Operator (AEMO) role is to ‘keep the lights on’. It runs the short-term wholesale electricity market and has a separate planning role producing documents such as the Integrated Systems Plan. It also has a role planning the transmission network in Victoria, whereas in other states that’s done by the local transmission network company.

The Australian Energy Regulator (AER) enforces the market rules. As part of this, it regulates network costs at five-yearly intervals. Distribution and transmission companies propose tariffs that will raise enough revenue to cover their costs including maintenance, finance costs and construction of new assets, and the AER approves those it will allow.

A relatively new addition to the electricity landscape is the Energy Security Board. Formed in 2017 on the recommendation of Chief Scientist Dr. Alan Finkel, its role is to coordinate reforms and “provide whole-of-system oversight for energy security and reliability.” It consists of five members at time of writing, including the CEO or Chair of each of the AEMO, AEMC and AER.

Other parties with a role in the market include the private companies that own and manage generators in the interests of their shareholders.

Recent government intervention

As market bodies struggle to reform the electricity market, governments are starting to take matters into their own hands. In February 2020 the Victorian government announced that it will speed up development of new transmission by side-stepping the national approvals process involving the Australian Energy Regulator. Details are scarce, but it seems that the government will select projects in consultation with AEMO, AEMO will conduct tenders, the government will pay for construction and then the asset will be paid for by a combination of electricity consumers and taxpayers.

In March 2020 the Tasmanian government announced that it plans to double its state’s generation by 2040, leading to a 200% renewable energy supply. This level of generation will require additional transmission to Victoria—perhaps Tasmania will follow Victoria and bypass national processes to accelerate Marinus Link.

The NSW government is developing a renewable energy zone (REZ) in the state’s central west around Dubbo. The federal government is contributing funds for this project, together with transmission to connect Snowy Hydro 2.0 to Sydney and other initiatives.

The federal government is devoting money to several other unrelated energy projects. From a renewable perspective, the most significant is its underwriting of the important Snowy Hydro 2.0 project.

Government interventions such as those noted above may interfere with the competitive market. For example, through Snowy Hydro the federal government owns both generation assets and the electricity retailer Red Energy. When the government devotes taxpayer money to this entity, it may be boosting its capacity to compete with private companies.

If private investors perceive that government action is likely, they may delay committing to projects until its implications for market competition are clear. For example, in late 2018 the federal government announced that it would invest in ‘firm’ generation capacity via its Underwriting New Generation Investments program. As of March 2020, it had produced a shortlist of 12 projects, but no indication on which will proceed.

Seeking a solution

Current efforts to improve the transition of the electricity system focus on greater intervention in the competitive market. Based on the experience to date, Renew is highly concerned that such incremental reform may take too long to achieve the rapid transition of the sector that is required under climate imperatives. In the worst case, closure or failure of coal-fired generators could lead to blackouts if firm replacements aren’t built in sufficient time, and consumers will bear the unnecessary costs of a disorderly transition.

Stronger measures may be required in the form of a more coordinated, planned approach. For example, AEMO could be empowered to design and direct development of the grid as was done previously by state-based electricity commissions. It could raise tenders for private companies to construct and operate assets such as generation, energy storage and transmission. This option is not excluded by the Energy Security Board’s post-2025 Market Design process.

Once the physical transition is complete and closures of coal-fired power plant have ceased, a more competitive market could be reinstated. With governments already intervening to directly invest in the system, this coordinated planning option would allow for these projects to work together coherently. Luckily, many recent government investments are consistent with the required transition. For example, as noted above Snowy Hydro 2.0 and Marinus Link are both required for AEMO’s Step Change scenario.

Renew will be keeping a close ‘watching brief’ on developments in the coming months and will be further considering the options to achieve a faster transition of our electricity system, to ensure it develops coherently in the long-term interest of consumers.

Resources:

AEMO’s Draft 2020 ISP is at bit.ly/2TR0sDZ

Find Andrew’s full paper including references at renew.org.au/research/transition-delayed

Previous papers in the series:

renew.org.au/research/renewable-by-2030

renew.org.au/research/renewable-grid-possible

Further reading

ReNew

ReNew

Refuting myths about nuclear and renewable energy

There’s a lot of talk at present about nuclear energy being a strong contender in Australia’s energy market. But how much is political spin getting in the way of fact? Dr Mark Diesendorf unpacks some of the myths that are out there.

Read more Renewable grid

Renewable grid

Is a floating solar boom about to begin?

Rob McCann investigates the world of floating solar energy systems.

Read more Electric vehicles

Electric vehicles

5B or not 5B

Large scale commercial solar farms can be time consuming to install and commission. Lance Turner looks at a company that has solved those issues.

Read more