Q&A: Understanding carbon trading

Understanding carbon trading

Q —

When reading Renew, I always turn first to the Pears Report, but sometimes I think Alan Pears is so familiar with his subject that he forgets others are not. The third-last paragraph of the latest report had me puzzled for some time and, while I think I understand it, it raises more questions and makes me aware that I do not understand how carbon is traded in Australia.

I thought that all forms of pricing carbon had gone and had been replaced by a scheme, dating back to Abbott, in which big polluters were paid in advance not to exceed a certain target; and that this system had come in for criticism on the grounds that it would be too expensive and in any case would leave us short of our obligations. This is probably wrong or outdated so I would like to know what we are doing at present. If it is still operating, are the government and big business exceeding their targets and purchasing carbon offsets in the global market? Why is this tolerated—is it not an extraordinary abrogation of responsibility in this area?

The suggestion to buy carbon offsets as presents is great but what is meant by “buy and surrender these offsets without emitting”? Surrender to whom and what would I use emissions for? Secondly, it seems improbable that even an army of “little people” would have the purchasing power of the big corporations or government. Also, the available purchases vary significantly in price per tonne so would not the best strategy be to buy the cheapest first?

—Dick Varley

A —

Yes, maybe I did assume a lot—I was short of space and it would take most of an issue of Renew to explain it all properly.

Mandatory carbon pricing in Australia was shut down by the Abbott government. I was referring to the international scheme run by the UN under the Clean Development Mechanism (CDM), where developing countries can implement emission reduction measures and create carbon offsets if they meet the rules: for each tonne of emissions avoided under an activity that meets the CDM requirements, they create a certificate. These offset certificates can be sold to emitters in developed countries (and to governments to meet their Paris commitments), who can surrender them to the UN as an alternative to reducing their own emissions.

The website I referred to is fairly user-friendly and allows individuals to buy offsets from CDM projects and they are automatically surrendered through the website. Under the international carbon accounting mechanism, this is counted as additional abatement outside countries’ emission inventories. So if I buy a tonne of offsets through this website (and they are automatically surrendered) this means I have reduced my net emissions by a tonne of CO2 as measured by the official global accounting scheme. So I can offset my emissions from air travel or other activities that emit. I should probably have said ‘without net emissions’ rather than ‘without emitting’.

While the UN CDM scheme has plenty of critics (for good reason), the reality is that CDM offsets are ‘legal international currency’ so if I buy and surrender one, that is one less offset available for a big emitter to buy. I agree that we individuals can’t match the scale of big emitters, but my aim is to offset my emissions that I can’t avoid, and this is a way of doing it quite cheaply. And if people like me do buy CDM offsets in large enough quantities, it will push the price up a bit, which means developing countries will have a bit more money to fund emission-reduction activities, and the big emitters (and the Australian government) will have to pay a bit more for offsets, so they may be more interested in actually cutting their own emissions than just buying their way out of their obligations.

Given that all offsets that qualify under CDM are ‘equal’ (although it’s not quite as simple as that), buying the cheapest ones first does make sense—although some of the more expensive ones do have significant local social and environmental benefits that I don’t mind contributing to. So I buy a mix of cheap ones (under $1/tonne) and some more expensive ones—but even those are still under $10/tonne. Some of the more expensive ones also qualify as ‘Gold Standard’ which means they are verified by a group of environmental organisations and offer significant environmental/social benefits.

The scheme that replaced the carbon price in Australia is so-called Direct Action, and the Emission Reduction Fund (ERF) is the mechanism. The ERF uses ‘reverse auctions’ so organisations that want to take actions that cut emissions (or store carbon) can bid and, if successful, are paid an average of about $13/tonne of emissions avoided or stored—effectively we taxpayers are paying this price per tonne of emissions avoided. This is just like a carbon tax, but we are paying, not the businesses that emit! Yes, there is a lot of debate about this scheme, and it is not very good for lots of reasons!

Some carbon offsets created under Australia’s ERF also qualify as ‘additional’ global emission reduction, but there are some complexities and I don’t think individuals can buy small quantities of ERF offsets, so I prefer to use the UN website.

Given that Australia’s emissions are not declining at anywhere near the rate needed to meet our 2030 Paris commitment (although we will meet our 2020 commitment), it seems increasingly likely that the Australian government will have to buy offsets to compensate for a proportion of our emissions, instead of cutting local emissions by enough to meet our commitment. I agree that, as a wealthy country that could cut its emissions at little cost, or even while saving money, we should be doing much more.

I wish I could point readers to a simple but thorough explanation of all this, but I don’t know of any decent source. The Voluntary Carbon Markets Association used to publish explanations, but it has not been active for some years—a group of us are hoping to reinvigorate it, so maybe then I can refer people to it.

—Alan Pears

Related articles

Pears Report

Pears Report

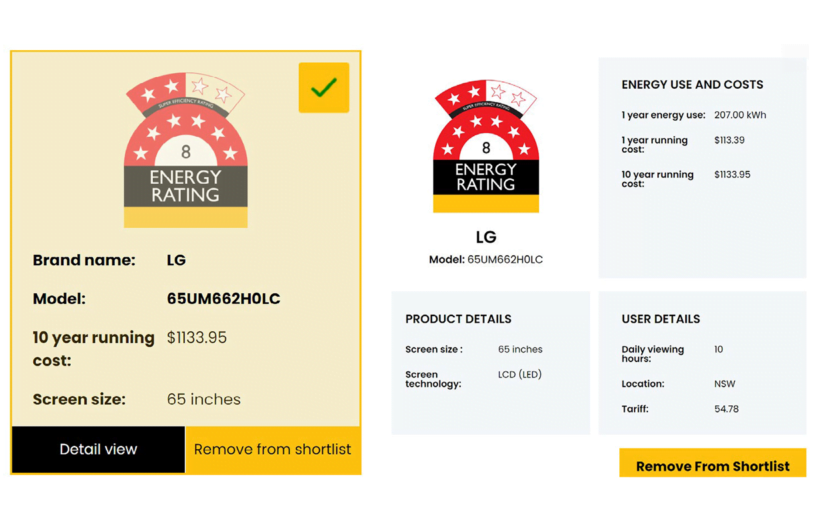

Fossil fuels, efficiency and TVs

Alan Pears brings us the latest news and analysis from the energy sector.

Read more Pears Report

Pears Report

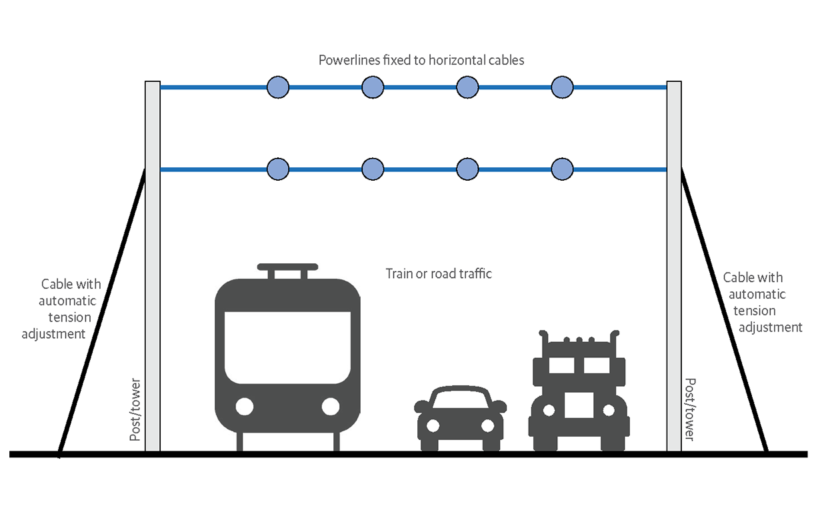

Transmission and emissions

Alan Pears brings us the latest news and analysis from the energy sector.

Read more Pears Report

Pears Report

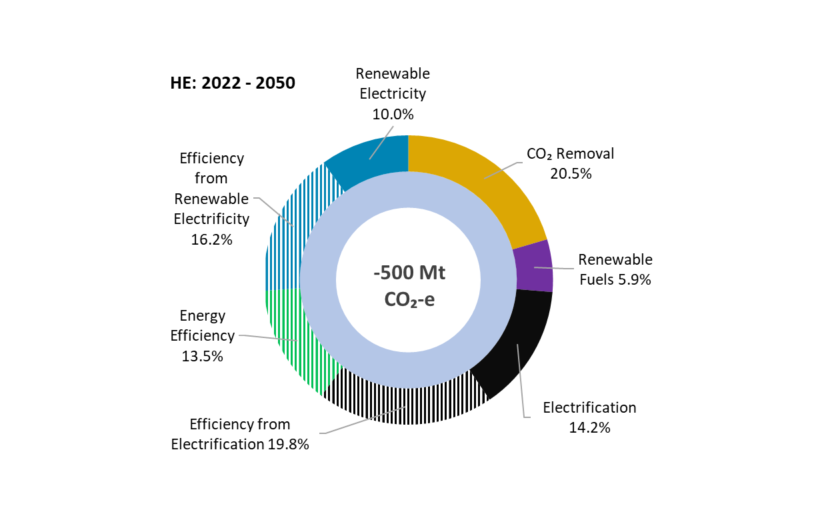

Energy matters

Alan Pears brings us the latest news and analysis from the energy sector.

Read more