We need a new design for our electricity market

Alan Pears exposes the cracks in our current energy system and explains why we need a better design for regulatory and policy decision-making.

A milestone!

The tension of an Australian election, the lived reality of the climate crisis and the global shocks of Putin’s invasion of Ukraine meant that an important milestone for me was overlooked: my 100th Renew column.

In 2016, Renew published an e-book of my first 75 columns, in which I wrote eight articles exploring the evolution of Australia’s energy and climate issues from the 1990s to 2016, and many thoughts about our energy and climate future.

Radical change since then has been reflected in my Renew columns. Today, we understand (some of) the fragility of centralised fossil-fuel energy supply, and how we are exposed to global market forces and prices. Renewable energy is now the cheapest supply option, but we still don’t drive energy efficiency and productivity at optimal levels.

We have fundamentally shifted climate action from ‘freezing in the dark’ and ‘destroying our economy’ to ‘smart business action,’ ‘consumer empowerment’ and ‘potential to grow export income and jobs’. We are beginning to recognise that high energy efficiency solutions deliver many benefits beyond saving energy.

We have not, however, confronted the scale of trauma, economic damage and environment loss caused by decades of policy failure, lies and compromise on climate change.

Does returning electricity to public ownership matter?

Recent energy-price spikes, closures of smaller energy retailers and the chaos around increasingly unreliable coa-fired l power stations have encouraged debate about public versus private ownership. There are no simple answers.

Some publicly-owned electricity generators (e.g. Snowy Hydro and Queensland generators) have taken advantage of market conditions to charge high prices, just like the private ones. My impression is that state treasuries encourage this as a less-visible alternative to increasing state taxes. Ownership is not really the key issue.

State governments have the strongest incentives to ensure affordable, reliable, sustainable energy systems. History has shown that, if the lights go out, state governments lose power. So it is not surprising to see state (and territory) governments aggressively acting to sort out our energy mess.

The present electricity market was designed by economic fundamentalists and privatisation-obsessed politicians. This market design has never worked very well. Its shortcomings have been masked by factors such as the large amount of existing (mainly base-load) generation capacity, a significant increase in plant utilisation and an explosive growth of renewable generation, combined with lower-than-expected demand. Recent global energy shortages and the lived experience of climate change have just exposed the weaknesses.

Electricity prices consist of wholesale prices, transmission and network charges, and retailing margins. GST and environmental programs also contribute to pricing.

Wholesale electricity prices are shaped by the ‘spot’ market. This market’s design encourages volatile prices and allows windfall profits. In every five-minute bidding period, the spot price paid to the highest-priced generator needed to maintain supply is also paid to all generators that bid and operate. When gas or hydro sets a high price, low-bidding renewables and coal generators with low operating costs make windfall profits! Over time, this influences all electricity, and the consumer pays.

The principle underlying this market is to provide signals to investors to build new supply capacity. This is crude and expensive, and has led to volatility and enormous money flows from consumers to multi-national businesses that don’t pay much tax in Australia and have narrow short-term perspectives that distort investment in public interest solutions.

State and territory governments have found that negotiating long-term supply agreements through auctions (eg. ACT and Victoria) can deliver low, stable prices while reducing costs and risk for project developers. Victoria is going one step further by injecting public equity that should deliver solid financial returns to Victorians.

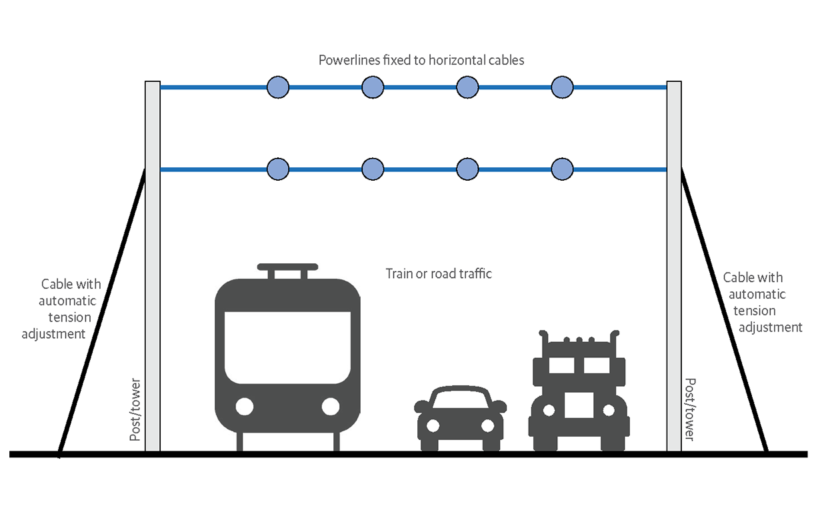

Network (poles and wires) pricing is also problematic. Network operators are regulated regional monopolies that comprise up to half of consumer energy costs. Transmission is highly regulated. They have been ‘privatised’ but not exposed to markets. Indeed, many of our electricity and gas supply assets are now owned by governments of other countries! Networks seem to be very profitable low-risk assets.

Electricity network funding is dominated by ‘postage stamp’ pricing. If I send a letter to a nearby address or far away, I pay the same price for the stamp. That approach is applied to electricity networks. That’s why rooftop solar exports are paid so little, as networks are paid the same price whether you use their infrastructure to deliver power down the street or hundreds of kilometres away! This pricing structure creates an economic barrier to community batteries and other local energy solutions.

In retailing, the competitive model incurs serious costs. Each retailer has highly paid managers, must operate expensive software, and faces significant costs of customer ‘churn’—consumers switching retailers. Retailers often take advantage of passive or loyal customers with higher pricing—as in many other industries. ‘Default’ tariffs have been introduced to limit such practices.

Legislation controlling network operators, retailers and other aspects of energy markets exists at state level. So each state has the capacity to act independently, which they do. For example, NSW, Victoria, ACT and South Australia have retailer-obligation schemes that require energy retailers to fund state government efficiency incentive programs.

Economic analysis and energy policy: Building regulation case study

Recent debate about strengthening home building regulations from 6 to 7 Stars provides a worrying perspective on just how the breadth and assumptions in economic analysis can change important policy decisions.

The original ‘consultation’ Regulatory Impact Statement (RIS) concluded that upgrading from 6 to 7 Stars was terrible economics. It found this would only return a 35-cent benefit for each dollar invested, imposing large costs on the Australian economy.

After a flood of community support for change, a revised RIS was prepared. Now, 7 Stars returned 80 cents per dollar spent at an economy-wide level and, at a household level, it saved $1.30 for each dollar invested. Additional factors were identified that could justify more stringency, including enhanced social equity, amenity, health, resilience to extreme weather events and power outages, and meeting future GHG emission reduction commitments.

Comparison of the two reports raises questions:

• Why did the benefit-cost ratio change so much?

• Why is the difference between household outcome and economy-wide outcome so big?

The strong public response to the consultation and emphasis on social justice, health and resilience were critically important. The additional analysis in the revised report should have been done earlier, as it clearly made a big difference.

The second question was answered with ‘Fixed network and retail costs that are saved by households still need to be recovered by energy retailers, and by using wholesale energy prices (as a proxy for avoided resource costs) and changes in generation and network investment’.

This approach is flawed. It assumes a regulatory change must have no adverse financial impact on the energy-supply industry’s profits, and that industry can’t reduce impact through competent innovation—like other industries. Buildings in new developments would reduce required network capacity. New homes in existing areas would free up network capacity for higher density redevelopment and EV charging.

Using a discount rate of 7% per annum for long-lived investments in this economic analysis is ridiculous: many countries use 3%. Relative to a discount rate of 7%, using 3% values savings 30 years into the future around 3.5 times higher.

We need a better approach to evaluating the multiple benefits of sustainability measures for regulatory and policy decision-making.

Further reading

Pears Report

Pears Report

Fossil fuels, efficiency and TVs

Alan Pears brings us the latest news and analysis from the energy sector.

Read more Climate change

Climate change

What we can learn from Spain’s response to heatwaves

As Australia heads into a summer set to be marked by climate change and El Niño, resilience to extreme heat is front of mind. Renew’s Policy and Advocacy Manager Rob McLeod reports on Spanish responses to heatwaves and the lessons for Australia.

Read more Pears Report

Pears Report

Transmission and emissions

Alan Pears brings us the latest news and analysis from the energy sector.

Read more