Solar gardens

Can solar gardens help more people access the renewable energy revolution? And what are the financial and legal considerations? Pilot studies by the Institute for Sustainable Futures and Community Power Agency are giving some answers.

A solar garden is an energy system in which a central solar PV system is installed, likely close to residential areas. Customers can lease or buy panels in the ‘garden’, and a participating retailer credits the energy from those panels against each customer’s home electricity bill. It’s a bit like the solar panels are on the customer’s own roof—although there are additional fees involved in an Australian setting which makes this less attractive financially than rooftop solar.

Why are solar gardens being considered?

A solar garden opens up purchasing a solar system to those who may be excluded from traditional system ownership, including those who live in rental accommodation (29.6% of Australians) or apartments (13.6%), or those with shady or shared roofs.

Key questions in the Australian energy market are whether such an approach is ‘legal’—does it meet all regulatory requirements—and whether it makes financial sense: will the customers of the garden be better off and will the solar garden itself be financially viable for its owner.

Both these questions, along with a consideration of whether there was a desire for such systems from consumers, were recently investigated in research by the Institute for Sustainable Futures (ISF) at the University of Technology Sydney, in partnership with Community Power Agency (CPA). An additional key concern was whether such solar gardens could assist low-income households, both to enable them to be part of the renewable energy transition and to reduce their energy bills.

How solar gardens differ from other community energy projects

The solar garden model is different from both an investment in solar panels, and participation in a community solar business. A straight investment, like ClearSky’s project of rooftop panels on the Bakery Maison in Revesby, NSW, means participants receive dividends from power generation but do not own the infrastructure itself. In a community business model, like SolarShare’s projects in the ACT, shareholders receive dividends from the shared array and are also responsible for the ownership and management of the infrastructure. In solar gardens, the system doesn’t require a host site to be the primary beneficiary of the energy (as the bakery is in Revesby), so other sites become possible. Participants here also require a contract with a retailer, and their financial benefit comes as credit towards their power bills (rather than as a paid-out dividend).

The ISF research

Several potential projects were investigated to examine the viability of a solar garden in different locations around Australia. Participants came from community groups, local councils, energy retailers and social welfare organisations, with projects located in urban and rural areas in NSW (Blacktown, Byron Bay and Shoalhaven), Victoria (Swan Hill) and Queensland (regional). Locations in NSW and Victoria had already shown strong interest in community energy projects.

Each pilot project went beyond just modelling. They looked for a viable location for the solar garden (including, in one case, a preliminary agreement with council on the site and lease arrangement), investigated the likely capital and operational expenditure (capex and opex), and worked through potential financial relationships both for a power purchase agreement (PPA) between the retailer and solar garden, and billing arrangements for solar garden customers.

To work out the financial viability, ISF developed a financial assessment tool, which enabled each project to model the financial result for their solar garden and customers based on varying parameters, such as capex, opex, subsidies, customer energy usage profiles and energy payment levels. See ‘Financial viability’ below for more on what this research found.

Law firm Norton Rose Fulbright reviewed key legal and regulatory questions and found that there are no major legal barriers to a solar garden in Australia, although there are complexities to setting one up. They produced guides and templates to assist solar garden implementation, including a sample contract between the energy retailer and a solar garden customer.

ISF conducted market research, in focus groups and online, to assess how desirable consumers found the solar garden model and how best to promote it to them. In a nutshell, the research found that consumers did want to participate in a solar garden provided it could show similar financial results to rooftop solar or at least around a 17% to 20% discount on bills. Financial savings were generally considered more important than environmental benefits, and participants were not generally interested in subsidising low-income members, although they were interested in gift subscriptions for family and friends.

Financial viability

Financial viability for solar gardens is perhaps the trickiest issue in an Australian context, something that was borne out by the ISF research. It found that the financial prospects of solar gardens are marginal without subsidies. However, as ISF points out, subsidies are available to those installing rooftop solar via STCs and state-based incentives (such as Victoria’s current 50% subsidy up to a limit of $2225), so it could be considered equitable for a similar level of subsidies to be available to solar gardens (and thus renters and apartment dwellers unable to access the current subsidies). Whether this is the best use of such funds will depend on the level of subsidies required to reach a similar return to rooftop solar, and whether there are other cheaper mechanisms to achieve bill savings for these groups—and how much value is placed by these groups on being part of a renewable energy transition.

Why is the financial viability so tricky in Australia? This is because there are network and retailer costs involved whenever the grid is used to transport energy from a solar farm via a retailer to the customer.

In contrast, solar gardens have been gaining ground in the USA due to their financial viability. As of 2018, Colorado had at least 19 projects running, the most of any US state. US community solar gardens use virtual net metering: solar garden customers are not charged anything to use the electricity network to get electricity from the solar garden to their home, so the potential benefit is the same as from rooftop solar; of course, this may create problems for the network operator in the long term.

Virtual net metering doesn’t yet exist in Australia; it requires a regulatory change, which has previously been rejected by the Australian Energy Market Commission (the ’law-maker’ in the National Electricity Market). Without it, solar gardens customers are paying full network (and retailer) charges for the electricity they consume that is tied to the generation from their solar garden share, and this significantly reduces the value to the participating household.

How do the financials work in an Australian solar garden?

In the model proposed by ISF and tested in the pilot projects, the solar garden’s establishment and ongoing (forward-estimated) operational costs would be paid for, at least in part, by the purchase or lease of panels by customers. This could be subsidised by government or other sources. There may also be subsidies in the form of a low-cost lease for a project site. The ISF modelling also assumes that the solar garden management company is a not-for-profit entity, which needs to cover its costs, but not make a profit from the garden.

The solar garden entity would not be paid for the energy generated by a customer’s

panels; rather, payments are made by the retailer to the customer directly. Customers could receive a benefit for the electricity generated by their share in two ways. First, the household’s real-time consumption could be netted off against their share of generation occurring at the same time at the solar garden. Second, a feed-in tariff or similar payment could be paid, either for energy generated by the customer’s share that is above their energy use at that time or for all the energy generated if netting off is not used.

Netting off would require a billing change at the retailer to match the consumption and generation, but ISF believes such changes are feasible and that there are interested retailers. As noted previously, the benefit to the customer is not the full retail rate of the energy as there are network charges that will still be charged. To provide either netting off or a feed-in tariff, the retailer would charge a fee to cover their costs, possibly in the order of 4c/kWh (based on the ISF study and the project teams’ discussions with retailers). This means the return is less than householders would receive from solar on their own roof.

Feed-in tariffs are currently only available for residential solar generation, not generation from a solar farm. However, the researchers believe that a strong ‘equity’ argument can be made to enable such a payment to a solar garden’s customers at a similar level to current mandatory or suggested feed-in tariffs in each state. Jay Rutovitz from ISF says that there is no regulatory barrier to a retailer doing this; however, retailers might be less likely to implement this without regulation or a guidance note to support it.

The research also found that a larger solar garden of 1 MW scale or larger is better financially, as any fixed management and maintenance costs can be shared among a larger set of customers.

Enova behind-the-meter solar garden

Enova Energy, based in the Northern Rivers region of NSW, also participated in the research project and has been working on a ‘behind-the-meter’ solar garden, where the solar panels go on a host site’s rooftop; such projects can benefit from the favourable economics of the host site using the energy as it’s generated. Enova plans to manage and maintain a 99 kW community-owned solar garden, which their customers can buy into in 1 kW lots (around $1000 per kW). It’s planned that customers would receive credits against their power bills of between 8% and 23% of their investment per year, for the 20-year lifespan of the panels. Payback is estimated to take five years. The ATO has handed down a ruling that solar garden credits will not be taxed as income. Members can sell and gift shares, or move and keep shares—as long as they stay with Enova. Some panels for low-income households and community organisations will be offered through grants sourced by Enova and Community-Owned Renewable Energy Mullumbimby (COREM), and there is a list of individuals ready to buy in as soon as a suitable rooftop is found.

Finding “the Goldilocks-size roof”, as Enova Chair Alison Crook puts it, is the greatest challenge. The panels will be installed and maintained on a business’s rooftop at no cost to the owner or tenant, and the host will receive a long-term, discounted energy-supply contract for the 20-year agreement. After that, the panels will belong to the host. For the perfect rooftop, Enova is seeking a business which uses a reasonable amount of energy all days of the week and throughout the year. (This limits the participation of schools and many community organisations, for example.) As Enova’s licence covers all of Australia except Victoria, the garden can be set up almost anywhere on the grid. The company is also working to set up solar gardens in collaboration with a major corporation and it has received a grant from Sydney City Council to do the feasibility study. Enova is also working with the Border Trust Community Foundation in the Albury–Wodonga region.

Modelled results

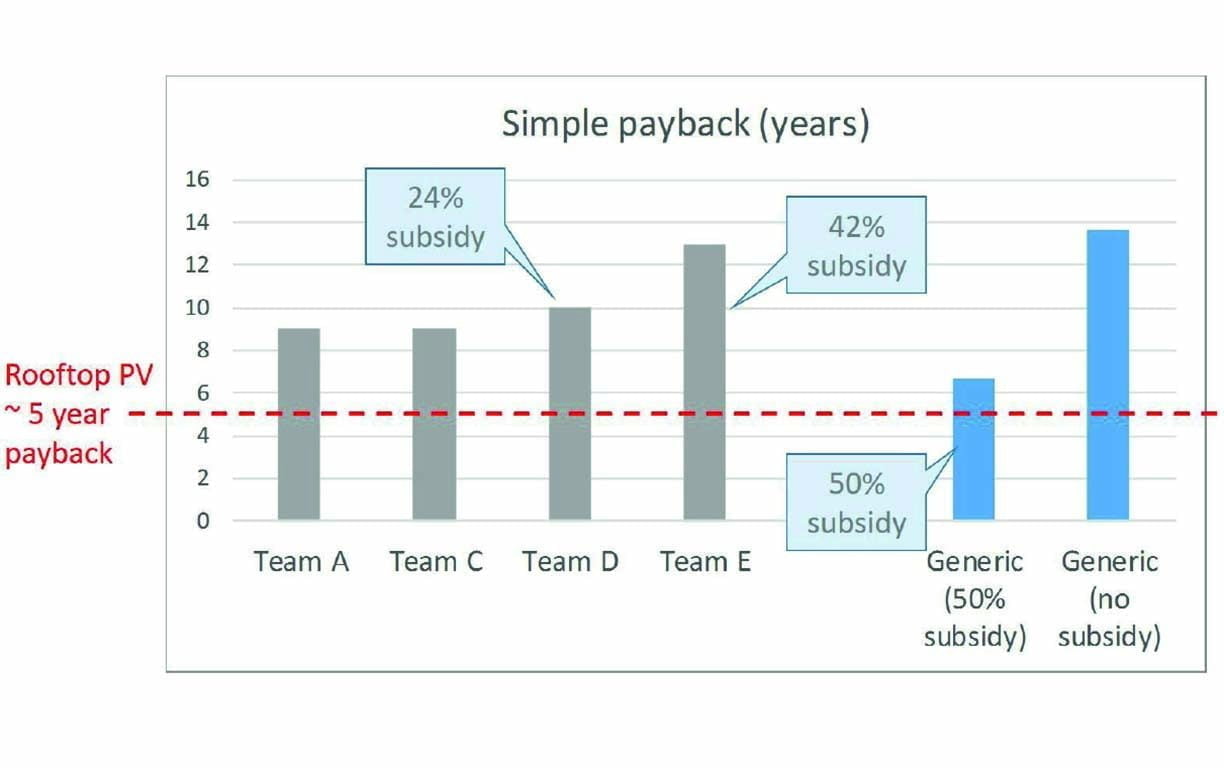

In the ISF study, it is assumed that customers either purchase a 2 kW share or lease a 3 kW share. The results show that, without subsidy, the simple payback period for customers is much longer than for rooftop solar: in the order of 13 to 14 years, compared to five or six years for a similar-sized rooftop solar system. The exact payback will vary depending on the solar garden cost and the negotiated customer payments. In fact, each pilot project’s modelling came up with different costs, payment approaches (some assumed no netting off and just a feed-in tariff) and different payback periods; see Figure 1.

The 13 to 14 years is based on a ‘generic’ model, assuming an average of the parameters used by the pilot projects, including a feed-in tariff of 8.4 to 10 c/kWh, netting off of coincident generation and consumption with a retailer charge of 4 c/kWh, and a cost of $4800 for a 2 kW share. To get this payback down to closer to six years, ISF modelled that around a 50% subsidy would be required, or around $2400 for a 2 kW share. With subsidies, consumers would see average bill savings of between $290 and $370 every year; without them, it might be only $50 to $100.

Leasing requires a higher subsidy of around 60% to get a similar result, and the research also found that a 3 kW lease was needed for customers to see a benefit of a scale that customers thought worthwhile. This sees the lease subsidy being around $3800.

Leasing is designed for low-income households who can’t afford the upfront payment. The customer would repay the lease on their bill, with the repayments being lower than the savings, and modelled with around a 12-year lease lifetime. The solar garden management company would take out a low-interest loan via a bank or council interested to support the project and pay back that loan using the lease repayments. The study makes the point that if a low-income household has a suitable roof for solar, it would be better to subsidise solar on the household’s own roof rather than in a solar garden, as this would provide a greater benefit to the customer.

The Shoalhaven pilot

Repower Shoalhaven is the driving force behind one carefully researched solar garden proposal. Located on NSW’s south coast, the group formed four or five years ago to promote the installation of solar on existing premises through local community investment. To date, they have raised more than $1 million and installed over 1 MW of solar PV on commercial premises in the Shoalhaven area. A solar garden is being explored by a six-person subcommittee, “a Dad’s Army of retirees, bar one” according to spokesperson Bob Hayward. In addition to giving locked-out customers and commercial premises equitable access to renewable energy, Repower aims to provide a model that successfully demonstrates a transition to a low-carbon future.

The subcommittee formed about 15 months ago to start exploring ‘front of the meter’ solar options, and Repower was soon invited to participate in the IFS/CPA study. The subcommittee considered this “a great lift in terms of getting more information about how to deliver a larger project”. Shoalhaven City Council committed to providing a suitable site and obtaining the necessary approvals, while Repower contributes project management and finance.

To achieve its social access aim, Repower anticipates that the project’s legal structure will be a distributing cooperative, which shares profits with around 2000 members. This cooperative will then own a limited company Special Purpose Vehicle to oversee development and management. To set up the project, it will likely initially use a distributive investment structure, relying on individual investments, grants and possibly commercial loans. The commercial loans would be paid off as a priority, and subscriptions could also be opened to low-income participants.

The location explored was a portion of a 12 ha disused tip site, currently vacant and cleared, and close to sealed roads and the 11 kV power network. The subcommittee investigated a 4 MW solar array, which would provide around 5468 MWh per year and require around $5 million in capital costs to establish. The system would incorporate ground-mounted non-tracking solar PV panels; tracking panels would be better economically, but they’re beyond the project’s fundraising abilities. Budgeting was completed for preconstruction costs ($178,000 for legals, governance, finance and geotechnical), including an amount set aside for design and approval for grid connection—this $75,000 would be at risk if the project didn’t then proceed. Preliminary discussions have been held with retailers and estimates calculated for grid connection ($200,000), operations and maintenance ($65,000) and replacement parts ($10,000 per year in a sinking fund).

Repower were planning to apply for NSW state grants and begin project engineering and grid-connection approvals in 2019. Unfortunately, the tip site was recently found to be subject to native title claims, so the council is still seeking to clarify the land’s status. Until that can be resolved, the project is on hold. If the scheme can go ahead on this site, Repower will need a formal retail agreement and secure grant funding towards preconstruction and construction costs before the solar garden can advance. We look forward to updates on Repower’s projects to “provide energy from the Shoalhaven, for the Shoalhaven”.

In conclusion

Where could the much-needed subsidies come from? Community Power Agency has been lobbying to make support for individual households available to solar garden projects. The NSW government is currently running a 15,000 household solar trial for low-income consumers, and has announced $30 million for the support of community energy projects, covering wind, solar and energy storage in 70 communities. In its pre-election energy policy, federal Labor has also promised $100 million for a community power network. The NSW and Labor funds already make allowances for solar gardens.

And finally, some of the legalities are complex because solar gardens are an unfamiliar organisational structure. The framework chosen will dictate some contractual relationships and assessments of risk and responsibility, but what happens when a project member leaves? Who takes that risk on board then? And what happens if a member moves house, or moves out of the retailer’s territory?

The prototypes suggested a range of solutions to this. In the Blacktown and Queensland cases, members would be obliged to sell their share if they leave the local area or retailers’ territory, while Swan Hill participants could keep their share regardless of where they live or which retailer they use. Original Shoalhaven members could keep their share as long as they stay with the same retailer, but others must sell if they leave the local area. These are difficult questions which the initial legal report can provide some pointers on, but project members will need to seek careful legal advice as their gardens get underway.

Supporting low-income households

Renew supports innovative project ideas such as solar gardens to assist low-income households and those in apartments (or other homes not suited to solar panels) to be able to participate in the energy transition. However, as demonstrated by the modelling in the report, solar gardens cannot flourish in Australia’s energy market without significant subsidy—and even with a significant level of subsidy, the benefits to the end customers appear to be relatively small. When considering how best to support low-income households and people in apartments, governments will have a range of policy options available. There are likely to be other more cost-effective and efficient ways of directly helping low-income households and apartment dwellers to reduce their bills.

More info:

DIY

DIY

Deleting the genset

If you have the need for the occasional use of a generator, then why not replace it with a much cleaner battery backup system instead? Lance Turner explains how.

Read more Renewable grid

Renewable grid

Is a floating solar boom about to begin?

Rob McCann investigates the world of floating solar energy systems.

Read more Products

Products

Product profile: Portable solar recharge hubs

Providing device recharging for events or outdoor areas with no access to electricity can be difficult, but the Furnicharge Freedom Hub makes it simple.

Read more