The question of disconnection: Gas demand is in decline, but is it falling fast enough?

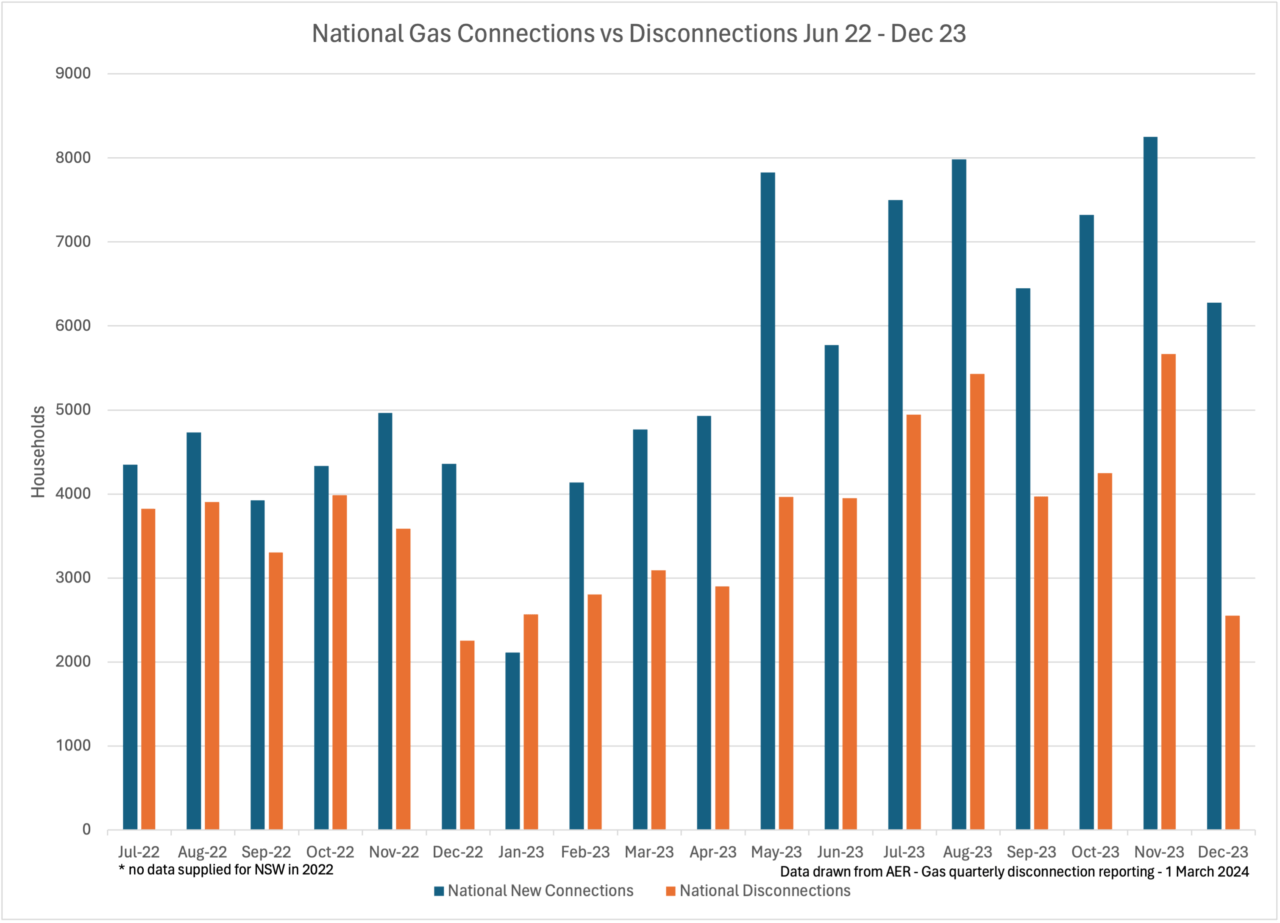

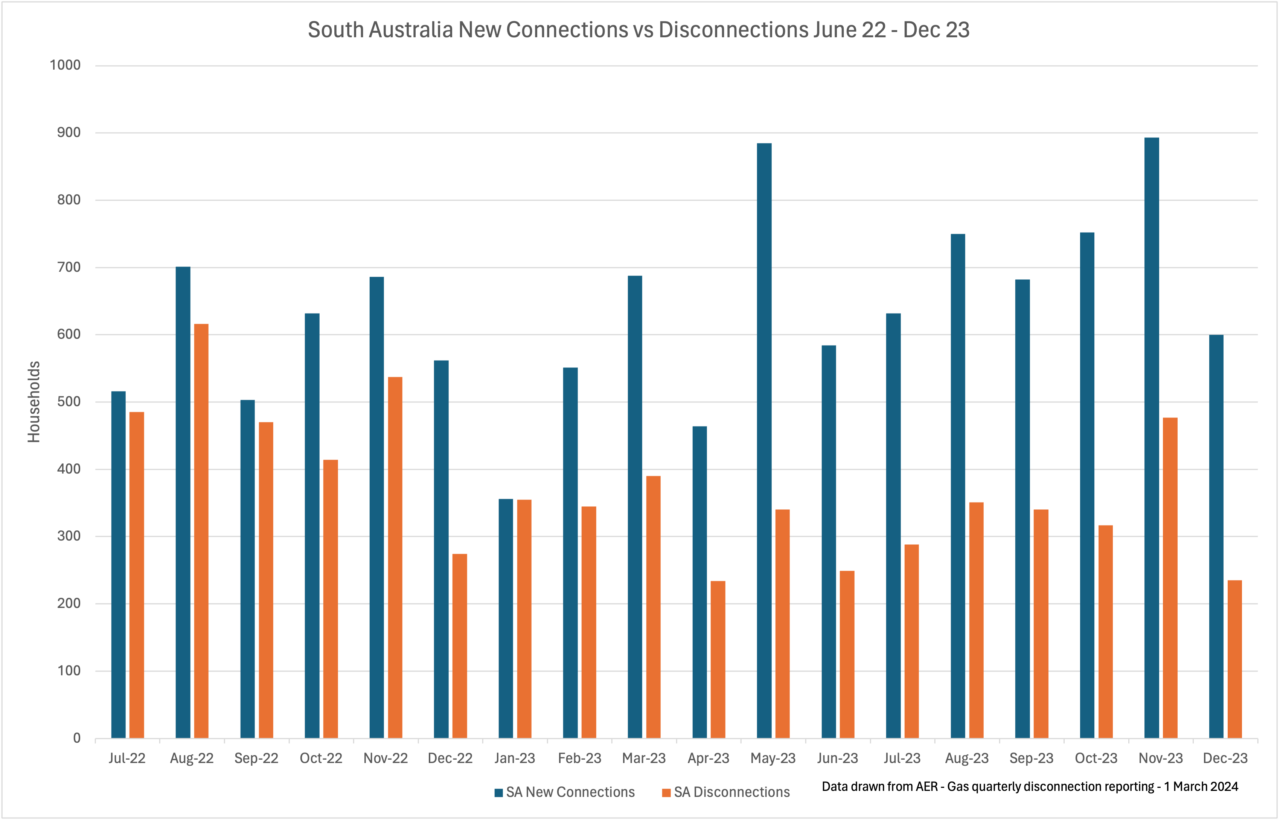

The latest figures on gas disconnection released by the Australian Energy Regulator reveal that across the southeast the number of homes moving away from gas is still lagging behind new connections.

Recent data from the AER may startle those of us who are keen to see support for household electrification match the deep pockets of gas companies eager to hold their share of the energy market.

The gas quarterly disconnection reporting data from the Australian Energy Regulator provides figures on the number of homes connecting and disconnecting to gas networks from June 2022 to December 2023. These dates take us to the day before the implementation of Victoria’s important decision to end new gas connections for homes requiring a planning permit from 1 January, 2024. As such, it provides a useful barometer for household electrification in the absence of decisive government policy.

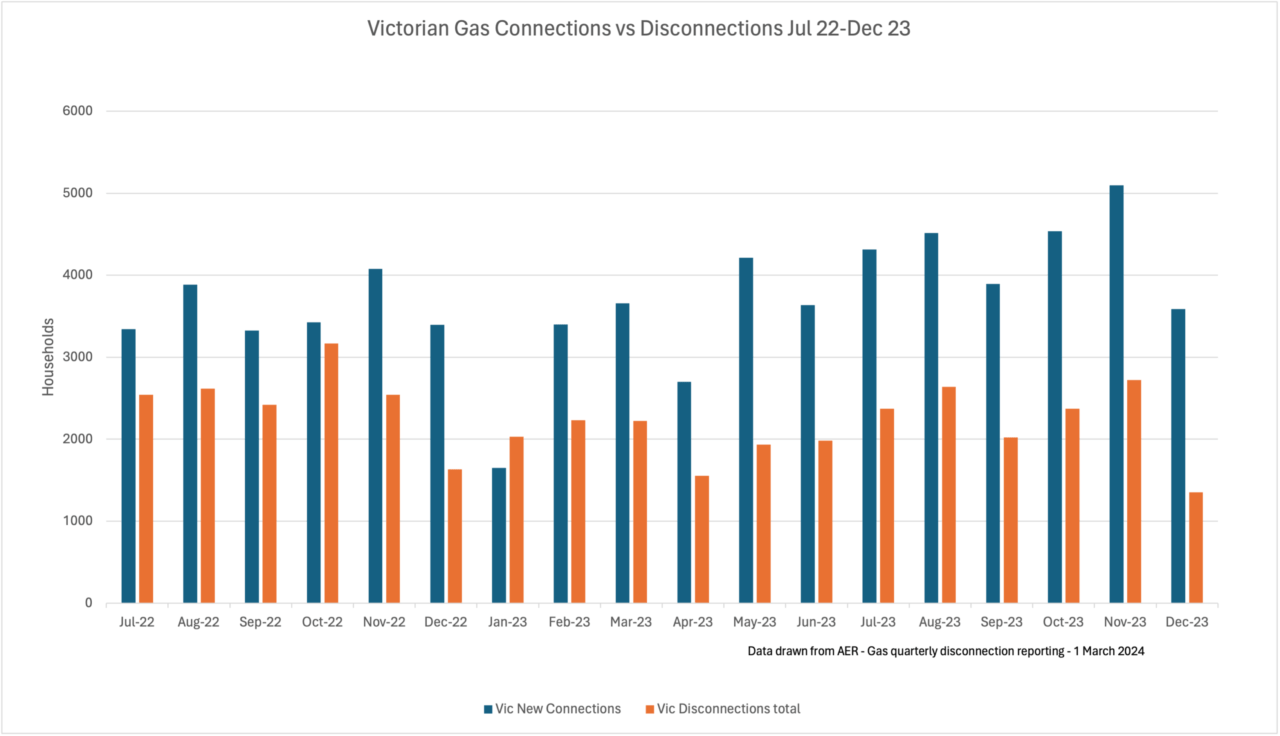

Victoria saw a total increase of 42,065 connections to the gas network, while total disconnections numbered 40,353. These figures may include temporary disconnections for the purposes of renovation, sale or changing rental status. Victoria, alongside NSW and SA was still lagging behind the ACT, where proactive policy to end new connections and support electrification was already in place.

In July 2023, Energy Consumers Australia suggested Australia may have reached a peak in residential gas customer numbers. Those of us working across this space have indeed watched some inroads being made across the residential sector that have emphasised emissions reductions targets while lauding the beginning of jurisdictional policies that encourage gas customers to switch to all-electric appliances. These actions, in turn, have encouraged some states to commit to de-prioritising gas supply as a means of encouraging proactive disconnection.

Last year’s quarterly AER data did reveal a slowing in residential gas customer number growth based largely on lagging development approval and construction rates. From March 2020, there were on average 1.8 additional residential electricity customers for every additional residential gas customer. But in 2022 this had increased to an average of 4.4 additional residential electricity customers for every additional residential gas customer.

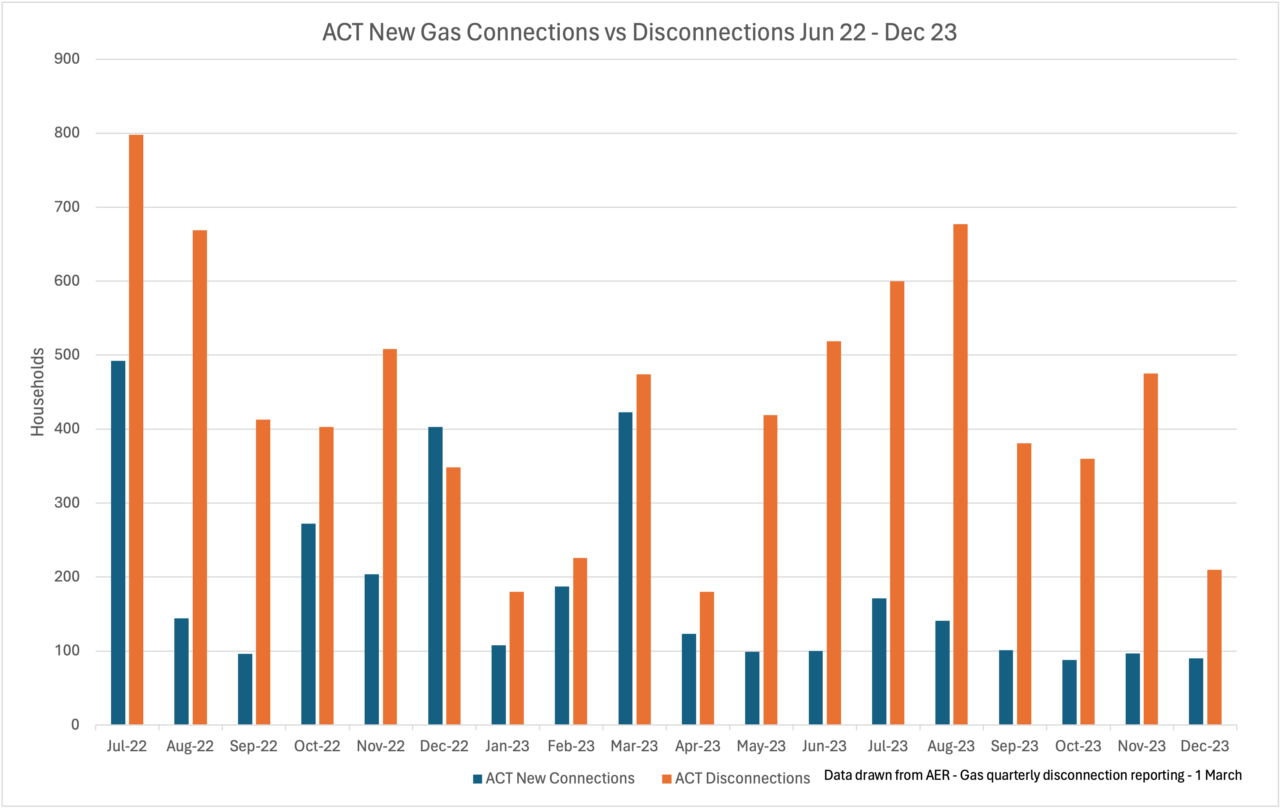

This year’s AER data shows new connections continuing to outnumber those seeking to get away from fossil gas across all states except the ACT. With data reflecting residential connections across SA, VIC, ACT and NSW, we can trace the relative policy adjustments and triggers across these states and how it has (and in real terms, minimally) impacted the number of actual disconnections (both abolishment and temporary disconnection) vs the number of new connections across the same period.

AER data collects information on all forms of disconnection and tracks new connections made over the same period. Across VIC, SA, ACT and NSW (JGN provider only), actual customer numbers continue to increase, except in the ACT which offers the most incentives for residents to go all-electric. Over the 2019-2021 period, Evoenergy reported 8,910 new connections – almost 3,000 new connections per year but since the gas ban brought in during 2023, the ACT saw only 3339 new connections over the 18-months to Dec 2023, while disconnections totalled 7840 with 756 abolishments. This is a clear indication of the work undertaken by the ACT government to dis-incentivise gas and facilitate all-electric homes by offering subsidies and interest-free loans.

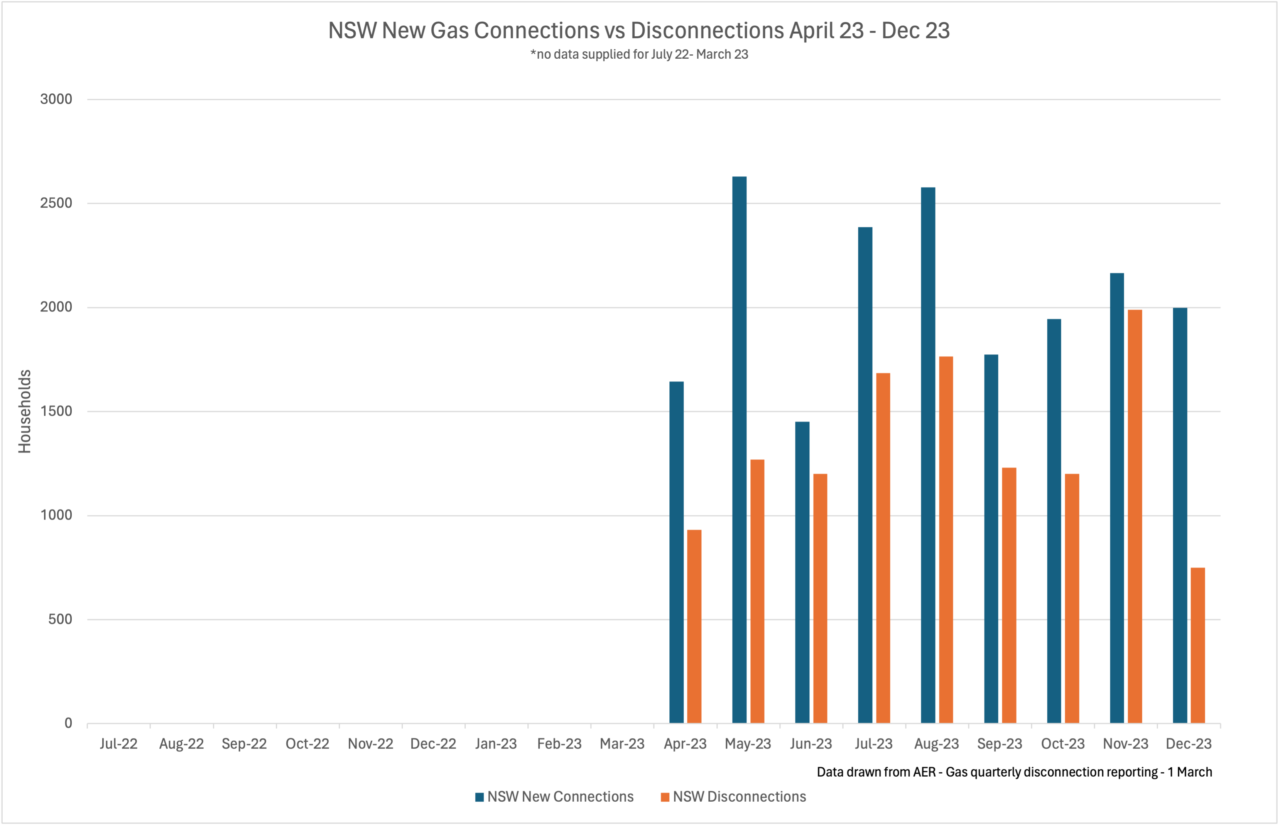

While Victorian gas customer numbers for Ausnet (one of three Vic providers) have gone from 757k in mid-2022 to 784k, the same timeframe saw customers with EvoEnergy in the ACT shrink from 154,448 to 150,809. Likewise in NSW whose data was absent for most of 2022, JGN numbers have increased over the same timeframe from 1,458,983 to 1,491,766, an increase of 2.2%. Monthly averages of new gas connections in NSW sits at around 2063, while average disconnections is steady at around 1335, meaning there are roughly 3 connections being made for every 2 disconnections.

Over the same period, disconnections in Victoria were sitting at around 26,762 (without getting rid of the meter) and 2515 that removed the meter. Total abolishments were around 11k across the three gas providers, but over the same period new connections remained strong at 66,651, or roughly 3700 per month. Total disconnections in Victoria did drop over the 18 month period, but can also be attributed to those undertaking temporary repairs or renovations, and may not be full abolishment which averaged around 923 a month in total over the three providers.

With some data missing from NSW for disconnections during 2022, from April to Dec 2023 there were 9,633 disconnections, 2388 abolishments yet 20,215 new connections made to the gas network during the same period.

That some states are still allowing energy providers to charge oftentimes exorbitant fees for disconnection remains a disincentive for customers to completely abolish their meter, and the ongoing fees scheduled at $1 per day to remain connected are still in place across most states.

In not regulating the caps for fees that energy providers and retailers can pass on to the consumers, the government is effectively charging Australians to undertake the action themselves, which could just as easily be capped and regulated, as it was in Victoria from July 1, 2023. As energy analyst Tim Forcey has forcibly argued, “to assist stated aims of reducing fossil gas use, governments have already organised renewable energy credits and rebates for heat pumps. Why give with one hand and then take with the other?”

What is involved in disconnecting gas?

In our Getting Off Gas toolkit we outline some of the options as there are three ways a home can be disconnected from the gas network:

- Service abolishment. This involves permanent disconnection of your service pipe from the

street and removal of the gas meter. - Disconnection. This involves temporarily locking and installing a plug in the gas meter outlet. This service allows the gas connection to be re-used again in the future (e.g. after a major renovation is done).

- Meter removal. This removes the gas meter but leaves the service pipe in place. It is used primarily in apartment situations where other units retain their gas connection.

There are fee schedules for each state, and they can vary according to region and proximity. This will be determined by where you are and the distance between your house and the mains connection. Permanently abolishing a home’s gas connection attracts a $220 fee in Victoria but can be upwards of $1000 in other states that have yet to regulate.

What does the future hold?

In its newly released Future Gas Strategy, the Federal government confirms its intention to develop new gas supply and to support gas to remain in use beyond 2050. At the household level, the strategy assumes that households will progressively electrify as a result of lower energy bills for all-electric homes. However, the government offers no measures to support electrification beyond consumer choice, and expects gas to continue to be used in homes beyond 2050.

While there have been mixed messages coming from AEMO, the AER and from state and federal governments regarding incentivising consumers away from gas, there has been some movement in the retail space that brings some hope that the tide can turn away from new gas connections.

Momentum Energy, the mainland-based retail arm of state-owned generator Hydro Tasmania has just announced it will support its tens of thousands of residential gas customers to quit the fossil fuel, in a deal that offers to wipe the gas network disconnection cost and connect households to a specialist, end-to-end electrification advisor (one of Renew’s partner/sponsors Goodbye Gas). This type of deal was enabled because of the Australian Energy Regulator’s decision to set a fixed exit fee for Victorian customers, thus making this kind of offer easier for retailers to make.

The Victorian government has also recently banned gas companies from offering cash incentives or rebates to households that install major new gas appliances, or connect to the gas network, under the Gas Industry Act, reportedly as part of the Allan government’s updated Gas Substitution Roadmap. A new Gas Distribution Code of Conduct published by the Victorian Essential Services Commission will require distributors to publish clear consumer information on disconnecting or abolishing a connection, and will require any home or business that is still able to connect to the network to pay the full cost of doing so.

Switching from gas to an all-electric home may save households money but there is still a significant disincentive while states remain hands-off on regulating the abolishment fee, and/or do not chip in to help cover the costs required to upgrade home electrical supplies and related appliances. While the private sector and industry remains watchful of government levers, the states and territories that have mandated an end to residential gas connections are going to make more inroads in tipping the meter towards ending our reliance on fossil gas, and more towards supporting all-electric homes powered by renewables.