The end of the ICE age? Electric vehicle update

Is the end of the ICE (vehicle) age looming? Amid a flurry of announcements from car manufacturers and governments around the world, Bryce Gaton surveys the significant shifts away from ICE vehicles and towards electric.

Change is afoot in the electric vehicle (EV) world. More and more EV developments are being reported in mainstream media, including further markers of the looming end of the ICE age! In this case, ICE equals internal combustion engine, or the standard petrol or diesel car. So let’s look at what’s been happening so far in 2018.

Electric vehicle sales

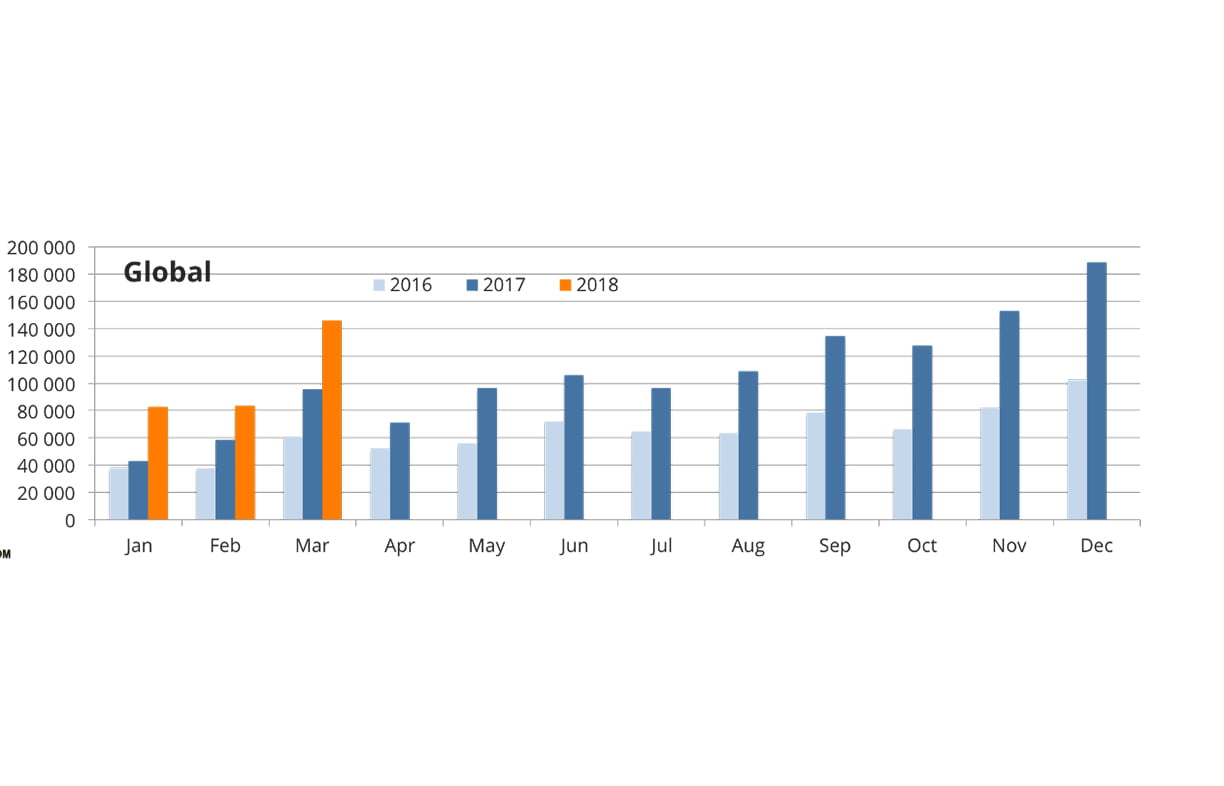

EV sales in the first quarter of 2018 hit 312,400 worldwide, 59% higher than for the same quarter in 2017. Of these sales, 66% were pure EVs (battery-only) and 34% were plug-in hybrid EVs (EVs with a plug-in rechargeable battery and an ICE engine); see Figure 1.

Even in Australia, sales of EVs were reportedly up 132% for the quarter—albeit from a very low base in 2017 when few EVs were available here. Australian EV sales currently sit at around 1000 annually, excluding Tesla sales (Tesla doesn’t provide sales data to VFACTS, the private body collating Australian car sales data), which is less than 0.1% of annual new car sales.

Planning for charging stations

In Australia, one hurdle in the way of significant EV sales has been the lack of public charging infrastructure. However, in a significant shift, almost all Australian states and some businesses are addressing this.

Queensland now has what it claims as the “world’s longest electric vehicle super highway in a single state”, after recently completing the first stage of a fast charging network to allow electric vehicles to travel from the Gold Coast to Cairns and inland from Brisbane to Toowoomba (see Figure 2 and further info at www.bit.ly/2xHTcBr).

For businesses, councils or other groups interested in installing charging stations, the Queensland government has also recently released a Practice Note (www.bit.ly/2xJ7Qs5) outlining key principles for planning electric vehicle charging to “support the selection of the right type of infrastructure at the right location.”

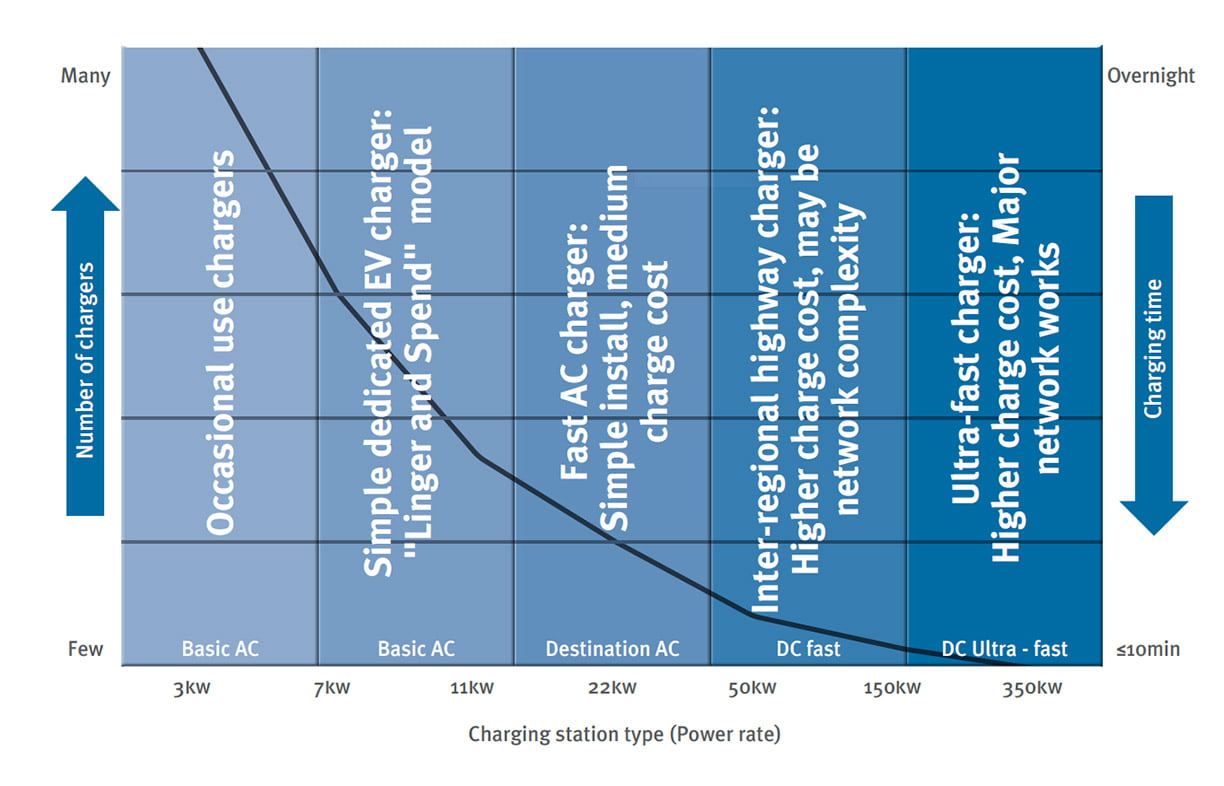

The document includes a detailed introduction covering EV charging basics (including the helpful infographic in Figure 3), plus a practical guide to choosing the most appropriate charger type for a proposed site and tips on cost recovery.

Although the document is Queensland-specific, it makes a useful starting point for any community group or local chamber of commerce that is beginning their journey in advocating for, planning or installing EV charging infrastructure.

In the ACT, the government has just released a comprehensive action plan to guide the ACT’s transition to zero emission vehicles. The listed actions include a requirement for all new multi-unit and mixed-use developments to install vehicle charging infrastructure. It also discusses working with local and state governments to facilitate the installation of charging stations on major routes to and from Canberra including routes to Sydney and coastal areas.

In Victoria, Infrastructure Victoria has been asked by the government to prepare a 30-year plan exploring the infrastructure needs of automated and zero emission vehicles, with that report due in October this year. The parliamentary inquiry into electric vehicles has recently released its report (www.bit.ly/2sw093s), which shows just how far behind Victoria is in supporting the introduction of EVs. Hopefully that report plus the Infrastructure Victoria report due in October will spur Victoria into action.

It’s not all about government action. Tesla has just announced two further investments in EV charging in Australia. The first is for 18 more superchargers to link the Great Ocean Road to its existing routes, creating the Broome to Bundaberg and Townsville to Torquay routes. The second is their intention to add an additional 500 superchargers to their existing Australian network.

At the start of the year, Jaguar LandRover announced that it will install 50 charging stations in its dealer network to support the introduction of the Jaguar I-Pace EV and the coming Range Rover plug-in hybrid EV. They also confirmed they’re in discussions with other premium vehicle manufacturers to rollout a fast-charge DC network to rival the Tesla supercharger system.

Couple all these new announcements with the late 2017 ones of 40 more charging stations in NSW and the completion of the EV charging hub in Adelaide, and we can see that the preparation for the transition to EVs is gathering pace.

Speed of charging

My prediction in the article ‘Plug Wars’ in ReNew 141 that the settling of the charging plug standards is likely to herald the start of a ‘charging speed advertising battle’ seems to be holding up, with recent announcements. The charging standard CCS is moving to 150 kW, allowing for charging speeds up to three times faster than the earlier CHAdeMO fast-charge system. And a standard for CCS 300/350 kW is currently being negotiated. Porsche already has plans to release a car using the 300 kW or 350 kW charging standard in 2020. It is worth noting that 350 kW is moving very close to petrol station refuelling rates. With charging speed limitations one of the few remaining arguments in favour of the hydrogen fuel cell EV, was that knocking sound the hammering of yet another nail into the hydrogen car coffin?

Model choice

After charging station availability, comes the next biggest hurdle to Australian EV ownership: actually having some new EV options to buy! Fortunately, things are changing there too, however glacial the pace appears for those waiting for offerings in the more mainstream vehicle segments.

Jaguar Australia is soon to launch the pure EV version of their E-Pace, called the I-Pace. With a battery size of 90 kWh and a range of 480 km (on the new, more ‘real world’ WLTP test cycle being adopted in the EU), it offers the first true competitor to Tesla’s Model X. Due in the third quarter of this year, Jaguar is already taking preorders.

Also on the good news front, Renault has dropped the ‘business only’ requirement to buy their Zoe hatch and Kangoo ZE van. However, there are still only two or three dealers in Australia authorised to sell them.

On a more worrisome note for potential EV buyers in Australia, while both the Hyundai Ioniq and Kona EVs were expected to arrive later this year, Hyundai has recently delayed deliveries and stopped taking orders for the Ioniq electric in North America (rumoured to be due to a battery supply bottleneck). Enquiries to Hyundai in Australia have also revealed a sudden coyness about the release date for both the Ioniq and Kona EVs here.

It also appears the new Nissan Leaf for Australia has been delayed a further six months and will not be sold here until at least March 2019; originally it was to be September this year. And while on the delayed EV arrivals front, the Tesla Model 3 is unlikely to reach Australia until late 2019 at the earliest—and at least 2020 for anyone who was not at the front of the queue on the day reservations opened here in Australia. This follows the announcement that production of righthand drive versions will not commence until mid-2019. But that delay was at least expected: Tesla is operating true to form, having never set a deadline it has not missed!

To finish on a more positive front on EV availability, another part of the ACT’s ‘Transition to Zero Emissions Vehicles Action Plan’ included setting aggressive targets for government purchasing of electric passenger vehicles over the next two years. One happy outcome of this will be that as leases end in the following two to four years, an increasing supply of good secondhand EVs will come onto the private market.

Marking the end of the ICE age?

Meanwhile, VW Group (comprising Volkswagen, Audi, Seat, Skoda, Bentleigh, Bugatti, Lamborghini, Porsche, Ducati, Scania and Man) is keeping up its reputation of making regular EV announcements immediately before a new iteration of the Dieselgate scandal appears in the news. Their EV news does get more exciting each time! Recent announcements from them include:

- plans to launch an EV a month from 2019, and have 30 new electric models by 2025

- signing lithium battery supply contracts worth over AU$33 billion with LG Chem, Samsung and CATL, then six weeks later nearly doubling this to contracts worth AU$63 billion

- Audi alone predicting they will sell 800,000 EVs (mainly battery-only EVs) by 2025

- rolling out at least 2800 new charging stations (mainly CCS) in the USA as part of their settlement with US regulators over the Dieselgate scandal

- and lots more diesel models being shown to have defeat devices, along with class actions by disappointed VW owners and criminal charges laid against top VW executives in the USA. (Oops, no the latter were definitely not from VW Group!)

Volvo recently announced that in 2019 the choice of ICE Volvos will be reduced through dropping the diesel option from all new model lines; at the same time, EV choices will be increased. They expect that by 2025 half of their sales will be pure EVs and the rest either plug-in hybrid or hybrid EVs.

In both the USA and the UK, electricity utility companies are lining up to back EV growth. In the USA, several electric utilities are offering incentives between US$1200 and US$10,000 for their customers to buy EVs. In the UK, the national grid operator has come out in favour of moving the end date for ICE sales back from 2040 to 2030, saying they were totally confident they could meet the extra electricity demand created by EVs by that date.

Related articles

Transport & travel

Transport & travel

Petroleum is fast becoming a dirty word

John Hermans explains the negatives of the petroleum industry.

Read more DIY

DIY

Bring on the electric ute

Bryce Gaton asks, will 2023 be the Australian ‘Year of the electric light commercial vehicle’?

Read more Transport & travel

Transport & travel

Biofuel vs battery

John Hermans gives his opinion on the best power source for electric vehicles.

Read more